CHINHOYI — A community based micro finance project is making a difference to hundreds of ordinary people with its efforts to reduce poverty by providing material and equipment which stirs community development.

BY NUNURAI JENA

Wisrod micro finance has branches all over the country and provides building material, agricultural inputs, household property and school fees for informal traders and low income earners.

When one is caught up in the vicious loan circle commonly known as “chimbadzo,” it is very difficult to free oneself as one continues to sink deeper in debt.

But Wisrod’s approach is to provide clients’ requirements as per client’s specification and the clients pay later usually on a daily basis.

The micro finance organisation targets the informal sector, mainly vendors who do not have collateral. The only requirement is a “permanent” operating place and genuine residential address.

There are four portfolios namely hire purchase, agriculture input scheme, ordinary loan, funeral policy, micro housing loan and fees loan which attracts interests of 5% per month.

Clients are grouped in numbers of five to 10 members according to their type of business and locality.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

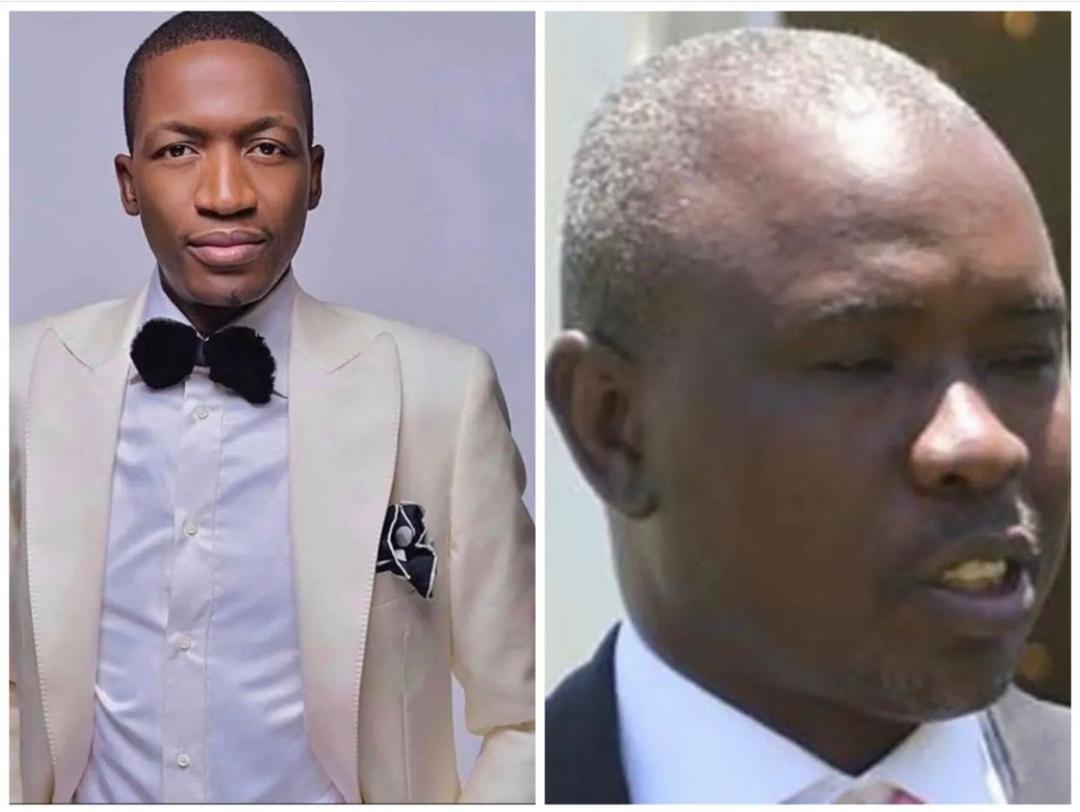

One of the two directors Nimrod Nyakanyaka, an accountant by profession says he has spent 20 years as an international development worker. He said his organisation was interested in seeing people’s lives change positively.

“We want to make money in such a way that the people being helped will be happy with the change in their lives. We believe in making a positive contribution to people’s lives,” said Nyakanyaka.

The group does not just give people money. It also trains them proper business management to enable them to be better entrepreneurs.

Chinhoyi based vegetable vendor Miriam Makisi says she is happy to be a member of Wisrod. She is paying US$7 every day for 100 days to pay off the US$500 worth of building material she got for the development of her Ruvimbo high-density stand.

“I could not have been able to develop my stand had Wisrod not bought the building materials,” she said.

Makisi said Wisrod was different from other micro finance groups in the sense that beneficiaries got their requirements first before repayment began.

“They buy and deliver our requirements. This is helpful because if we are given money chances are high that one can divert it to other things not meant for the loan,” she said.

Another vendor Jesca Tichaona said she was now able to send her twin children to boarding school courtesy of a loan of US$1 400 she received. She must repay the loan in four months’ time.

“They do not require bank application forms which take time and they give you the full amount requested not through the bank which is less cumbersome,” saidTichaona.

Farmer Ignatius Jiyangwa who is still paying for agricultural inputs given to him last year said such loans were helpful as they were not for immediate consumption.

“These loans are used for the purpose intended and they improve our lives. I managed to plough all my fields and luckily we had good rains and I’m expecting a bumper harvest. I am better off than last year” he said.

Another Wisrod director Lewis Tendayi Madafi, a banker by profession, said they combined two special skills — international development and banking.

“We just not lend. We lend to change people’s lives and go to those people whom no one wants to deal with — those on the lower end of the society,” he said. Madafi said experience taught him that if people were given money they did not do what they borrowed the money for.

“So we insist on providing the requirements and that makes us different from other financial institutions,” he said.