The town of Beitbridge, located on the southernmost tip of the country and border with neighbouring South Africa, has been for many years like a world of its own, different from the rest of Zimbabwe.

By Nqobile Bhebhe

Picture this: you arrive in Beitbridge and temperatures are hitting 41 degrees and your first thought is to have a glass of cold water.

You approach a water vendor and produce a 50 cent bond coin, only to be greeted with sarcastic laughter.

“What’s this? Your coins don’t work here, this is a different country. We accept only the rand,” says the vendor.

The rand has always been the preferred currency in the border town due to its proximity to South Africa.

While the official introduction of the multiple currency regime in 2009 took the country by storm, it had little effect on the popularity of the rand in this part of the country.

The introduction of bond coins last December was a non-event in Beitbridge, notwithstanding the fact that the coins are at par in value with the American currency.

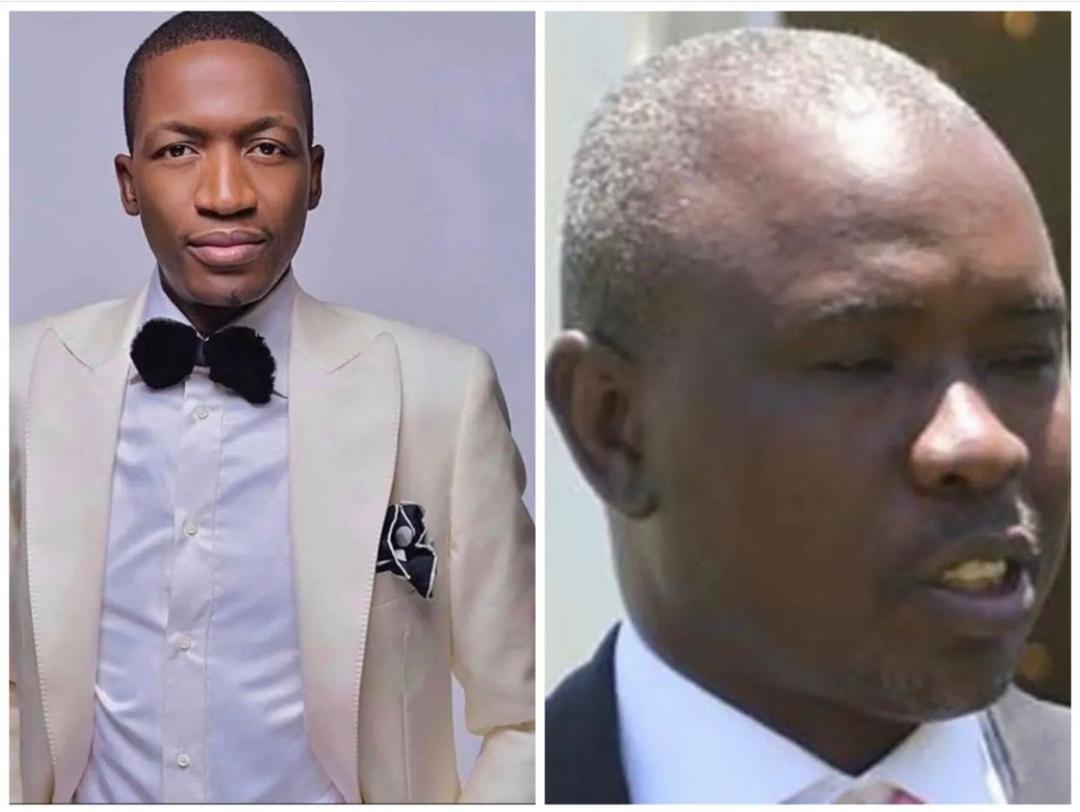

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Traders who spoke to The Standard at the border town on Wednesday said they would not trade in bond coins as it did not make business sense to them.

They said the rand was their first choice but with its continued slide on the market, the US dollar was slowly taking over.

Another vendor requested to have a look at the coins, claiming she had never seen them before.

“I have only heard of the coins from my relatives in West Nicholson, but I had never seen them. So I won’t accept them. They also look suspicious,” the vendor said.

Beitbridge Business Association chairman Clever Moyo said there was little appreciation of the coins in the town.

“Business here is mostly informal and because of our geographical location, the rand is dominant. The small traders don’t really want them [bond coins] for one simple reason. You can only use the bonds locally and if you try to convert them into rand, no one will accept them.

Besides, he said, most informal traders in this town did not have bank accounts and as such, could not transact easily with the bond coins.

Moyo said with the tumbling of the rand against the dollar, there was a swing towards the dollar.

“People now prefer the dollar to the rand, but the trick is they want the dollar in order to buy the rand. They opt for the dollar first, but because of the weakening rand, with the dollar you get more rands.

About 300km from the border post in Bulawayo, the battle for currency supremacy continues as most retailers and the transacting public are now reluctant to trade in the rand.

Commuter omnibuses are now charging R10 per trip, up from R7, or most preferably, a 50 cent bond coin.

The R10 fares have sparked outcry from commuters with Bulawayo United Passenger Transport Association (Bupta) secretary, Albert Ncube saying their members were cheating clients.

Ncube said: “As kombi operators, we don’t prescribe to the rate but we use the official rate obtaining at the banks and supermarkets. Those who are charging R10 in kombis will be charged.”