GOVERNMENT is mounting a fresh plan on Friday to revive operations at the moribund steel maker Ziscosteel, the latest of a string of futile attempts to rebuild Africa’s once largest integrated steelworks.

BY SHAME MAKOSHORI

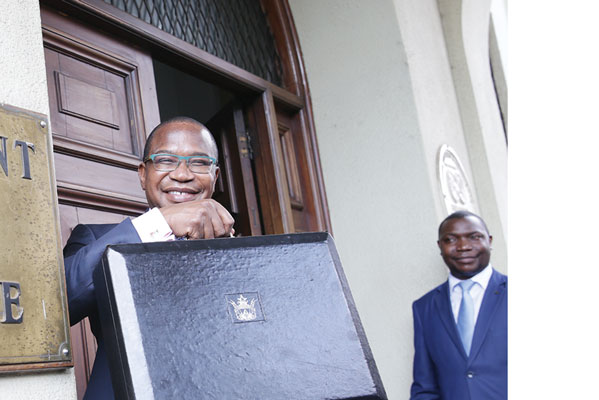

The revival strategy announced by Finance minister Mthuli Ncube will be part of a $2,3 billion industrialisation package deployed to the ministry of Industry and Commerce to reboot the economy following a string of firm failures.

For Zisco, the strategy will only be a stop-gap measure to keep some of its assets running while government, the major shareholder in the firm, scours the globe for new investors.

When operating at full throttle, Zisco presents several economic spinoffs on the Zimbabwean landscape where it injects funding into downstream industries like logistics operations, power generation and coal mining.

It is the reason why so much effort has been devoted in rebuilding the firm whose tentacles cascade into key assets like ZimChem, Lancashire Steel and Buchwa Iron Mining Company (Bimco).

Zisco went belly up over a decade ago under the weight of mismanagement and corruption.

Ncube rolled out a twin strategy to fight governance rot in state firms, which he hopes may save firms like Zisco.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

In the meantime, Ncube wants to keep current operations running by selling off heaps of mangled steel and crumbling infrastructure from the Zisco graveyard for funding.

“The revival of Ziscosteel is key to the economy through its potential benefits in job creation and value chain impact in companies such as National Railways of Zimbabwe and Hwange Colliery and the resultant savings in foreign currency in excess of US$1 billion through importation of steel products,” he said while presenting the 2021 budget last week.

“In 2021, government will resuscitate Ziscosteel through innovation and harnessing inward opportunities, while working closely with local investors.

“This will be done through courting new investors who will bring new technology and new skills.

“While the search for new investors is in progress, government is currently implementing a short-term roadmap of resuscitating the firm’s subsidiaries which include ZimChem, Lancashire Steel and Buchwa Iron Mining Company, among others.

“Accordingly, $2,3 billion has been allocated to the ministry of Industry and Commerce to spearhead the industrialisation thrust.”

In September, government cancelled a US$255 million Zisco recapitalisation deal inked with ZimCoke three years ago.

Under the deal, ZimCoke had snapped up Zisco’s coke-making assets ranging from the plant and machinery, land, buildings, to wagons and related coal-handling implements.

The transaction, which was seen as key towards recapitalising the firm, was cancelled because it was not favourable to Zisco’s interests.

It was the latest of a series of deals, including the long-drawn-out US$750 million Essar Holdings transaction, which ended up being terminated by the government in 2015.

The Indian conglomerate had acquired a 54% stake in the embattled steelmaker, which used to boast a 5 000-workforce during the peak of its operations.

A similar deal with another Indian company, Global Steel Holdings, also failed to materialise.

On Friday, Ncube said government had adopted a centralised ownership model for State Enterprises and Parastatals (SEP), in a departure from the current decentralised system.

The previous model was blamed for undermining State firms through governance deficiencies and weak oversight.

Through the reforms, government projects to complete on-going partial privatisation programmes in some SEP.

Ncube said the SEP reform agenda remains one of government’s key policy thrusts, as it strives to revitalise their operations.

SEPs used to contribute 40% to the country’s gross domestic product.

However, this has plummeted to about 12%.

“Zimbabwe has historically been following a decentralised SEPs ownership model, whereby the government shareholder function is spread across different line ministries,” Ncube said.

“This ownership model has been associated with a number of challenges, including inconsistencies in governance practices, ministerial interferences, delays and/or reversals of government-approved SEPs reforms due to vested interests within some line ministries and generally weak and passive oversight function, among others.”

Ncube said the decentralised model has also been related to the poor performance of the SEPs sector.

However, this has not only been experienced in Zimbabwe, but the world over, the minister noted.

“In line with international best practices, government took a deliberate decision to review the SEPs ownership model,” the minister added.

“Following approval by Cabinet, implementation of the new ownership model will also be one of the central SEPs reforms to be implemented in the 2021 fiscal year.”