IN the past two weeks, my arguments were resonating well with dollarisation proponents. I, however, cautioned that dollarisation must not be a long-term solution to Zimbabwe’s existing challenges. With time, it is more damaging, especially to small import-dependent economies like Zimbabwe.

The rapid re-dollarisation of the economy experienced last year as evidenced by the Reserve Bank of Zimbabwe’s (RBZ) metrics is an economic policy awakening to a historical fact that dollarisation is nearly permanent.

The only escape gate is through the implementation of prudent market-driven policies and reforms taking examples from among a few countries like Poland and Israel that successfully de-dollarised their economies.

But the reluctance by responsible authorities to implement robust reforms risk cementing Zimbabwe’s position as a permanent member of the globally dollarised economies. To me, dollarisation only postpones the problems, which is why I support it to be part of a solution set only for the short-to-medium term horizon.

Zimbabwe has been recycling its socio-economic and financial challenges since 1980 - hence, the persistence of adverse expectations, currency volatility, high inflation, dilapidating infrastructure, high cost of doing business, poor public service delivery and abject poverty.

With the rapidly shaping African Continental Free Trade Area (AfCTA), permanent dollarisation will be a big challenge for domestic firms. As such, swift policy actions must be taken now lest Zimbabwe plunges into a self-isolation camp away from AfCTA freely trading partners.

With United States dollar use, local firms will be rendered uncompetitive thus forcing Zimbabwe to institute protectionist trade policies and import substitution measures.

What actions then must be taken by the government to circumvent the looming economic disaster? As explained earlier, authorities must embark on a well-prepared reform agenda. I am glad that the government has taken the public debt resolution route.

- RBZ blocks Harare US dollar charges

- Industry cries foul over new export surrender requirements

- One stitch in time saves nine

- Banks keep NPLs in safe territory

Keep Reading

Western creditors have been clear since early 2000s that Zimbabwe must reform its economy, public institutions, political systems, and state-owned enterprises as a prerequisite to receiving debt relief.

With the government now laser-focused on tackling the debt conundrum, it signals its willingness to institute needed reforms. In essence, the government and its creditors will be exchanging debt relief and reforms.

Some readers may have reservations about the prioritisation of debt. As a fan of debt resolution, let me briefly provide some context of why debt resolution is critical.

Zimbabwe is inarguably rich in natural resources including those facing high global demand. But minerals require huge investments into exploration, surveying, and heavy machinery to be located, quantified, extracted, and transformed into finished products.

Guided by the development models followed by China and other Asian Tigers like Japan and South Korea, rapid economic transformation is only possible in a friendly business operating environment that attracts foreign investors.

Due to increased financial repression, many developing nations are largely characterised by shallow domestic financial markets. Inevitably, external sources of finance must be explored to augment and support these weak domestic financial markets.

Access to finance is a precondition for progressive development as many investors use debt financing from reputable international financiers to fund major projects. Furthermore, to import raw materials and other key supplies abroad, many players including foreign banks are also involved in this transaction value chain.

However, because of the US Office of Foreign Asset Control (Ofac) financial restrictions on Zimbabwe coupled with an expanding public debt, many foreign corresponding banks are now shunning the Zimbabwean market as a de-risking strategy.

In other words, unsustainable public debt stock is increasing the country’s investment risk premium. A risk and return analysis would show many potential investors and credit providers avoiding heavily indebted nations to minimise default risks.

So, to reduce debt-related risks and increase access to cheap external sources of finance, the debt problem must be resolved. It comes with a package of reforms to increase transparency and accountability in government. This is also one of the key drivers of private-sector investment.

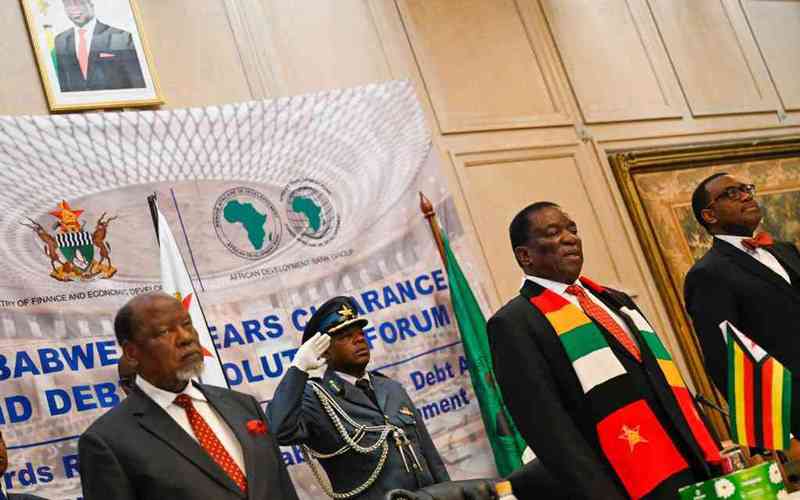

Last month, Zimbabwe held a high-level structured debt dialogue with its creditors and development partners. The dialogue was attended by the President Emmerson Mnangagwa, senior government officials, former Mozambique president Joaquim Chissano, African Development Bank (AfDB) president Dr Akinwumi Adesina, and civil society organisations, among others.

This debt dialogue shows that authorities are now committed to resolving the ballooning debt currently standing at US$17,6 billion — about 65% of the national output (GDP).

While this debt level is consistent with the Public Debt Management Act, which caps Zimbabwe’s debt-to-GDP ratio at 70%, it is exceeding the 60% threshold set by the Southern Africa Development Community’s (Sadc) macro-economic convergence targets.

More so, accumulating arrears and penalties show that Zimbabwe is in debt distress, that is, it is struggling to pay its debt and restructuring is required. These arrears and penalties are now constituting 45% of total external debt (US$14 billion) with the bulk (62,6%) being owed to bilateral creditors.

Over the years, Zimbabwe has tried to resolve its unsustainable debt stock to no avail. Doomed past initiatives include the 2015 Lima Process, the 2012 Zimbabwe Accelerated Arrears Clearance Debt and Development Strategy (ZAADS), and the 2010 Sustainable and Holistic Debt Strategy.

However, this time, it is likely that the ongoing debt dialogue processes will bring positive results. The intuition behind this position is the inclusion of a facilitator in one Chissano. Chissano is an elder statesman, seasoned politician and diplomat, who is crucial in cultivating political will to implement direly needed reforms.

Also, adding clout to the dialogue is the roping in of AfDB chief, Dr Adesina, an economist and banker, as Zimbabwe’s debt champion. Dr Adesina fully understands the demands of instituting economic and institutional reforms.

By virtue of also representing Zimbabwe’s major creditors, the AfDB chief will be key in negotiating debt relief, including the possibility of removal or suspension of sanctions. This is needed to reduce Zimbabwe’s investment risk premium thus improving capacity for debt servicing.

For full debt relief, creditors are demanding that Zimbabwe institutes robust economic, governance, and land tenure reforms. These reforms fit squarely to Zimbabwe’s aspirations of durable macro-economic stabilisation through the restoration of market confidence in the Zimbabwean dollar, thwarting of prevailing market pricing distortions, improving competition, encouraging disruptive innovation, and strengthening public institutions that are regarded by development economists as the rules of the game.

More so, land tenure reforms that seek to strengthen the protection of land rights, including the settlement of a US$3,5 billion Global Compensation Deed to former farm owners will likely bring closure to the chaotic and bloodbath fast-tracked land reform programme of the early 2000s. Thus, paving way for increased agricultural production and productivity through reduced reliance on state subsidies and increased farmers’ access to finance.

Nevertheless, the timing of the ongoing structured debt dialogues is worrisome and may likely constrain progress. It is generally difficult to garner full political will for robust implementation of reforms like political and electoral reforms from a government facing a re-election year. The quest to win an electoral vote, especially in its rural stronghold will likely force the ruling political administration to continue spending excessively and unsustainably.

Be that as it may, the initiation of these debt discussions is a move in the right direction which has the potential, post 2023 election period, to bring a lasting solution to Zimbabwe’s decades-long debt distress.

Sibanda is an economic analyst and researcher. He writes in his personal capacity. — [email protected] or Twitter: @bravon96.