ZIMPLATS recorded a jump in operating profit in the first quarter ended March 31 2013 steered by higher sales volumes, improved metal prices and a reduction in cost of production per ounce.

REPORT BY OUR STAFF

According to its financial results, operating profit at US$65,3 million was up 271% as compared to the same period last year.

The Australian Stock Exchange listed company said 4E (platinum, palladium, rhodium and gold) matte production was at 126,268 ounces during the quarter up 505% from the 20,863 ounces realised in the comparable period last year.

Zimplats said its Phase 2 expansion project was on course for full year 2015, but could be delayed due to cash constraints, and weaker commodity prices.

The Phase 2 expansion project is expected to increase production to 270 000 ounces per annum.

Zimplats said the company’s local spend (excluding payments to government and related institutions) at US$42 million or 57% of total payments, was in line with its commitment to supporting local industry.

Zimplats’ fiscal contribution of US$32 million, as calculated by direct and indirect taxes, during the quarter under review was 14% higher than the previous quarter and this was as a result of higher royalties and higher income tax in line with increased revenue and profitability, it said.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

The company recently lodged an objection to government’s plans to seize 27 948 hectares representing half of its mining claims.

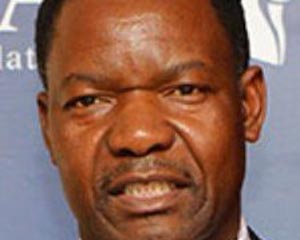

Zimplats chief executive officer Alex Mhembere said “this has been a strong quarter for the business and we are pleased with the contribution Zimplats continues to make to the Zimbabwean economy, especially in local procurement where 57% of our total payments are going to Zimbabwean companies”.

“As we continue discussions with government, we will drive national and industry development in line with national goals while protecting sound business conditions and practices,” Mhembere said.

In January this year, Impala Platinum concluded a non-binding term sheet with the Youth Development, Indigenisation and Empowerment ministry for the sale of a 51% stake of its Zimbabwe subsidiary, Zimplats, to various indigenous entities for US$971 million.