THE National Social Security Authority (NSSA) is set to collapse Capital Bank’s operations into a new financial institution the authority plans to establish.

BY OUR STAFF

NSSA or its nominee company is set to apply for a micro-bank licence, as it moves away from the merchant banking business that has failed to deliver profit.

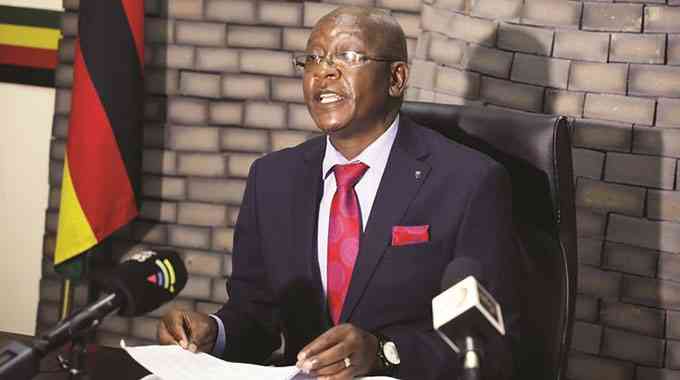

The new bank would be headed by current Capital Bank managing director, Lawrence Tamayi.

The move coincides with the retrenchment exercise currently ongoing at Capital Bank with executives saying the plan was meant to have leaner staffing levels.

Sources said the retrenchment was meant to ensure that the remaining staff would be absorbed by the new banking institution.

Impeccable sources said NSSA would take over Capital’s liabilities and all depositors would get their money back.

NSSA has an 84% shareholding in Capital with the remainder owned by founder, Patterson Timba and his team.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

The move comes after a realisation that Capital needs huge capital outlay and has failed to turn around since NSSA moved in.

Despite the rebranding exercise, the bank has failed to gain market acceptance from its predecessor, ReNaissance Merchant Bank (RMB) that had slipped into curatorship.

RMB was placed under curatorship in 2011 after an investigation by the central bank unearthed the abuse of depositors’ fund by founding shareholders.

NSSA moved into the then RMB last year in a US$24 million deal for 84% shareholding.

NSSA said at the time it was swooping in on RMB as a gateway to then Afre Corporation. RMB had 33% shareholding in Afre.

“What we have lost in Capital, we have more than gained in Afre. Our intention was never in the bank, but Afre,” a board member said on Friday.

Afre, recently renamed First Mutual Holdings, has interests in insurance, reinsurance and property investments, among others.

With NSSA calling the shots at First Mutual Holdings, the group is on a growth and has met some of the conditions prescribed by the insurance regulator such as the recapitalisation of subsidiaries and reorganisation of the board.