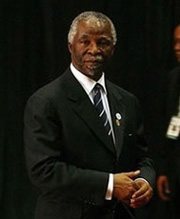

Maputo — Former President of South Africa Thabo Mbeki met with Armando Guebuza, President of the Republic of Mozambique, to discuss illicit financial flows in Africa. Mbeki, who is Chair of the 10-member High Level Panel on Illicit Financial Flows, said illegal transactions out of Africa were the single economic issue hampering Africa’s development.

ECA External Communications and Media Relations Section

It is estimated that Africa loses over USD$50 billion a year in illicit financial, exceeding the official development assistance to the continent, which stood at US$46,1 billion in 2012. The illicit financial flows find their way to developed countries mostly through multi-national companies and subsequently draining the continent of the much-needed resources.

Illicit financial flows constitute, among others, undocumented commercial transactions and criminal activities characterised by over-pricing, tax evasion, false declarations, mispricing of trade exports and imports facilitated by some 60 international tax havens and secrecy jurisdictions that enable creating and operating of millions of disguised corporations, oil companies, anonymous trust accounts and fake charitable foundations. Other techniques used include money laundering, transfer pricing and corruption.

During the closed door meeting, President Guebuza was appraised on the work of the high level panel since its establishment and inauguration in February 2012 by the United Nations Economic Commission for Africa, and the African Union to address the debilitating problem of illicit financial outflows from Africa.

The panel has held several consultations around the continent meeting with top government officials and other stakeholders. Previous meetings have taken place in Algeria, Democratic Republic of Congo, Kenya, Nigeria, Tunisia and Zambia.

During the two-day consultative meeting in Maputo, Mbeki is scheduled to meet with government ministers, top government officials, the private sector, civil society and other stakeholders to forge strategies on how to curb illegal money leaving Africa.

While illicit financial flows are a global problem, their impact on the continent is monumental thereby representing a significant threat to Africa’s governance and economic development. Current evidence shows that Africa lost over US$854 billion in illicit financial flows between 1970 and 2008 corresponding to a yearly average of about US$22 billion. In this period Mozambique is believed to have lost as much as US$25 billion.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

The trend has been increasing over time and especially in the last decade, with an annual average illicit financial flow of US$50 billion between 2000 and 2008.

These estimates may well be short of reality as they exclude such other forms of illicit financial flows from smuggling and mispricing of services. Some of the effects of illicit financial outflows are the draining of foreign exchange reserves, reduced tax collection, cancelling out of investment inflows and a worsening of poverty. Such outflows also undermine the rule of law, stifle trade and worsen macroeconomic conditions.