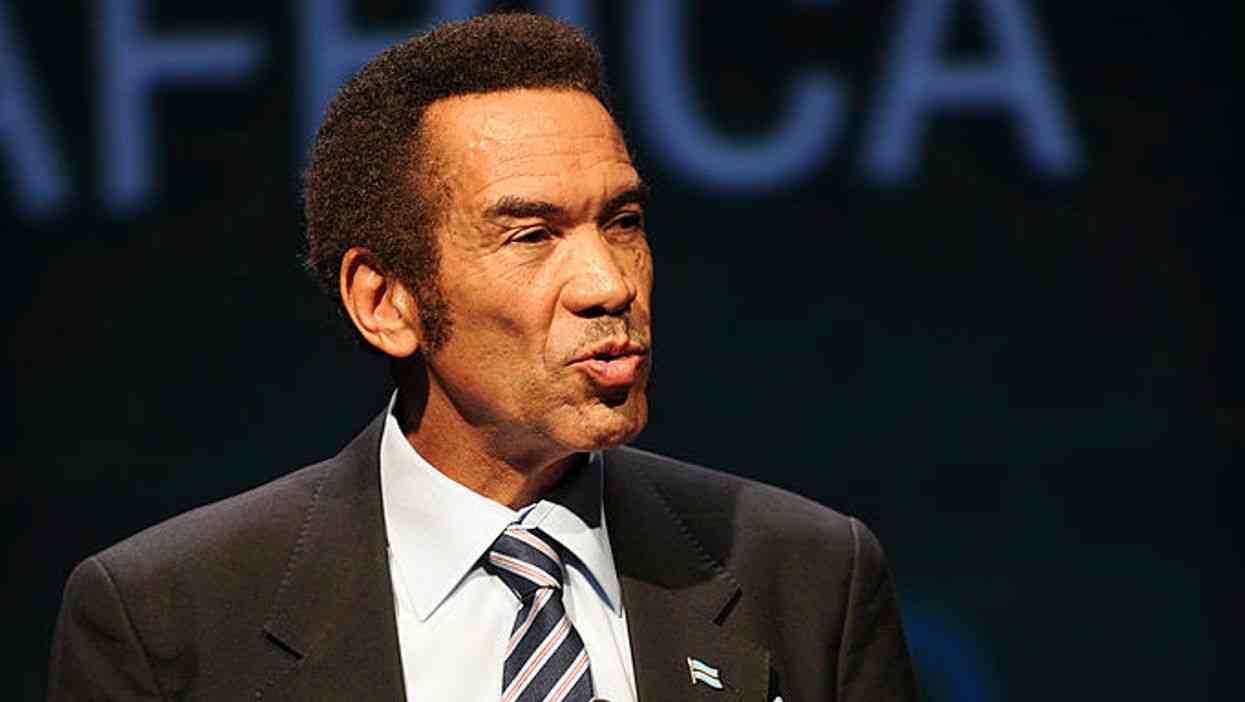

President Robert Mugabe flew out of the country last week to attend the Group of 77+China in Bolivia, leaving behind a country in turmoil.

BY NDAMU SANDU

His junket to South America, which will gobble thousands of dollars, comes 10 months after Zanu PF got unfettered powers to rule Zimbabwe.

In its election manifesto, Zanu PF promised Zimbabweans heaven on earth saying it would create value of US$7,3 billion from the indigenisation of 1 138 companies across 14 key sectors of the economy. It said it would generate over US$1,8 trillion created from the idle value of empowerment assets unlocked from parastatals, local authorities and mineral rights.

It said its various initiatives would create 2 265 million jobs across sectors of the economy and “contribute to export earnings, food security and to the fiscus among many other benefits including urban housing, and construction on peri-urban farms acquired during the land reform exercise”.

But 10 months on, the situation on the ground remains grim — and is getting worse by the day, amid growing signs that the economy is melting down, piling more misery on already struggling citizens.

Analysts said it was frightful that the government appeared clueless as evidenced by contradicting policy statements, especially on indigenisation — the price of factional infighting in Zanu PF that has spilled into government.

An industrialist said in an interview yesterday that joblessness and informalisation of the economy had reached alarming levels. He said there was need for foreign direct investment in infrastructure, manufacturing and mining.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

“We are still talking about reviewing investment laws and speaking in different directions with no sense of urgency,” the industrialist said.

A local analyst said the economy has been contracting due to liquidity challenges. He said the move by government to shift civil servants dates was a sign that the situation is deteriorating and was likely to get worse.

“The solution from day one has been clear. We need to craft investor-friendly policies which are clear and consistent so that we may be able to attract capital. Secondly, just like the European Union has said, there is need for security of investments,” the analyst said.

“Government must promote and protect investments under Bilateral Investment Protection and Promotion Agreements (Bippas).”

Zimbabwe Congress of Trade Unions (ZCTU) secretary general Japhet Moyo said the situation was dire for workers, 9 000 of whom have lost their jobs since last year.

In addition to job losses, Moyo said, many cases were piling at the Retrenchment Board. “We have been moaning on the number of applications, a clear indication that the industry is struggling,” Moyo said.

Moyo said the continuous shifting of civil servants’ paydays and the number of companies that were unable to pay salaries showed a particular picture of the state of the economy.”

The ZCTU boss said government should address the fundamentals including laws that attract investment, tax laws and favourable industrial relations.

“All these mean a lot to prospective investors. The informal economy is growing by the day. The question is: what makes people do business under the radar of the authorities but without paying taxes? People run away because government has stringent rules,” he said.

Willowvale’s plans to retrench have already received approval while newly appointed board chairman of the National Railways of Zimbabwe, Alvord Mabena said the board had to prepare “to take painful decisions to bring about the desired change” at the struggling rail parastatal.

In his acceptance speech, new Reserve Bank of Zimbabwe (RBZ) governor John Mangudya said the central bank had no tools to influence the economy directly under the multi-currency regime.

Mangudya said the bank’s strength “rests on relationship management, policy advice and the ability to put in place national beneficial financial structures to increase liquidity and resuscitate the economy so as to unlock value in the economy and to work towards meeting some of the critical objectives enunciated in Zim Asset”.

The outlook however remains gloomy with the World Bank lowering Zimbabwe’s growth projections to 2% this year from the 3% it had forecast in April.

Government projects the economy to grow by 6,1% this year and despite the new challenges facing the economy, it has not made any adjustments.

Last week, power utility Zesa announced a load shedding schedule which will be another blow to the manufacturing sector already beset by the absence of long-term funding.

Already, the manufacturing sector has warned that capacity utilisation was likely to dip to 30% this year from the 39,6% in 2013, painting a gloomy picture on the outlook.

The informal sector which caters for a big chunk of employees has not been spared from the power cuts.

In his 2014 national budget presentation, Finance minister Patrick Chinamasa said the old economy was dead and a new one, based on the informal sector, had been born, urging financial institutions to cater for the small to medium sized enterprises.

But at Bernito Complex in Mbare, Midreck Zengeni complains about his dying business. He said power cuts had hamstrung operations. Zengeni runs Zengeni engineering which manufactures window frames and scotch carts.

“We are working three days per week and this has affected our business,” he told The Standard yesterday.

Zengeni said very often nowadays, electricity was cut all day, only to be restored in the evening, meaning that they would have lost a day’s production. He said in some instances when power was restored, it would be insufficient to run heavy machinery.

Lazarus Zokota, who is into furniture manufacturing, said the power cuts meant that they were unable to supply goods ordered on time.

“We are now having problems with clients. They think we dupe them and yet we cannot afford generators,” Zokota said.

In the banking sector, a report by IH Securities, a research firm, said a significant threat to the economy and the banking sector in particular is the deflationary pressure that the country was experiencing.

“Due to subdued levels of demand, local businesses cannot maintain margins and have in some cases been forced to decrease prices. In our view, this began in 2013 and has worsened in the first half of 2014,” the firm said.

“The concern is of course, that declining prices would further discourage investment in those industries targeted at the local market.”

It said low revenue on the back of this development would also place further pressure on firms that are already faced with viability problems.

“Highly leveraged firms are especially of concern as these will be facing higher real debt burdens.”

Chinamasa could not be reached for comment yesterday.

Former Finance minister Tendai Biti said Zanu PF should apologise to the nation for having failed to run the economy.

“The economy is now worse off than it was in 1957 and Zim Asset [Zimbabwe Agenda for Sustainable Socio-Economic Transformation] is a joke,” he said.

Biti proposed the setting up of a National Transition Technical Council to run the affairs of the economy.

“You don’t put a bunch of failed politicians into running a struggling economy because it will worsen things,” he said.