WASHINGTON — Reserve Bank of Zimbabwe (RBZ) governor John Mangudya, last week announced the introduction of “bond notes” as an answer to the enduring liquidity crunch and an attempt to stimulate the country’s ailing economy.

The notes, coming in $2, $5, $10 and $20 denominations, and backed by $200 million from the African Export Import Bank (Afreximbank), will start circulating in two months.

Zimbabwe abandoned its own currency seven years ago as inflation spiralled to over 89,7 sextillion percent, at least according to one commentator.

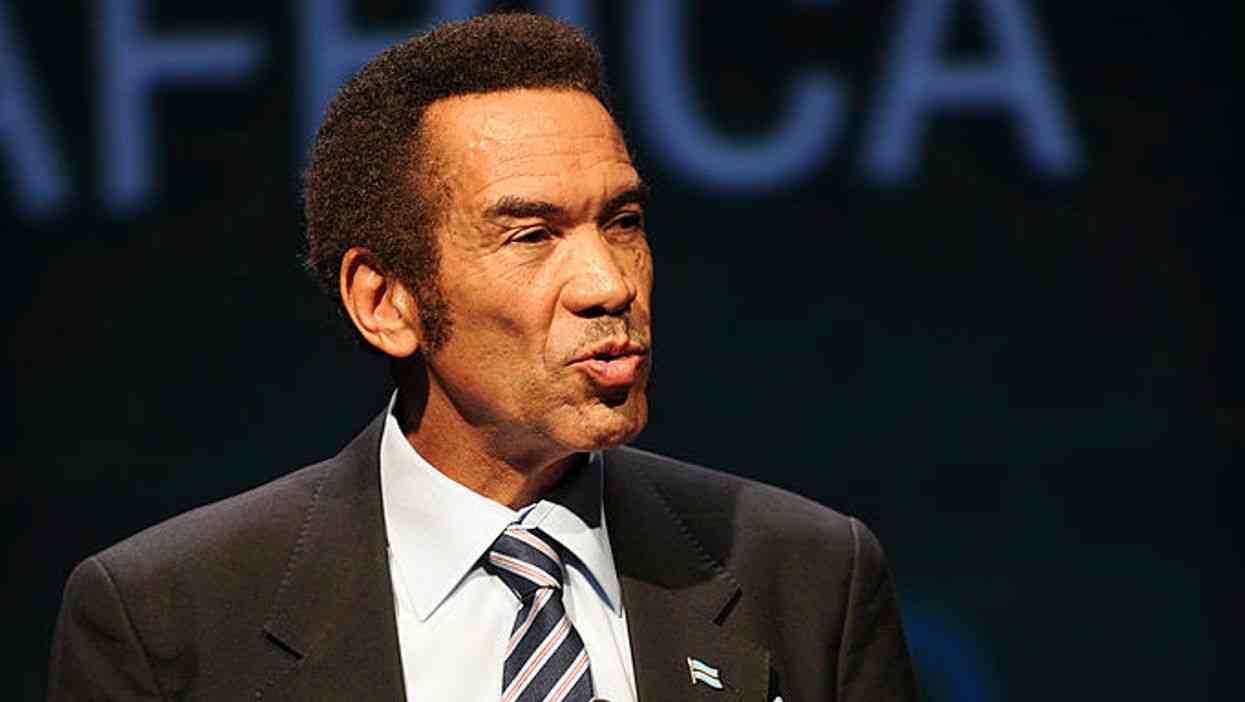

Critics and members of the public worry that the measure may be a harbinger for the reintroduction of the Zimbabwe dollar. VOA Studio 7 reached out to Mangudya (JM) who sought to allay fears, telling Blessing Zulu (BZ) exclusively, that this move is not a path towards the resurrection of the local currency.

BZ: First Dr Mangudya, what motivated you to want to introduce the bond notes and what is causing the cash shortages?

JM: As you are aware Blessing, the issue about cash shortages in Zimbabwe in some banks, not all banks, is attributable, as we have said to three factors. The first one is that the US dollar has become very strong and we have seen a shift from the usage of other currencies to the usage of the US dollar. So it means we now have what we call concentration risk.

We are concentrating on one currency and that is against the spirit of a multi-currency system, so obviously our intervention should deal with the spread of demand from one currency to the other currencies in the multiple currency systems. In 2009, the use of the US dollar was 49%, rand 49% and 2% for other currencies. Now, in 2016, it’s 95% US$, rand only 5% and other currencies almost 0%.

This is why the central bank is trying to restore and promote the widespread usage of currencies in the multi-currency basket.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

What we are saying is that as from May 5, all new US dollar foreign exchange receipts from the export of goods and services, including tobacco and gold sales, shall be converted by the RBZ at official exchange rate to 50% in US dollars, 40% in rand and the other 10% in euro.

This policy measure is to ensure that we spread the demand for cash among a wide range of currencies and in order to mitigate against concentration risk. That means a person can either withdraw the euro or can withdraw the rand and also the US dollar for purposes of meeting the transactions that are required under the multiple currency system.

BZ: Does this framework apply to diaspora remittances?

JM: No, no, that is a good question though. This framework shall not apply to diaspora remittances and non-governmental organisations. Those are free funds and we will continue to treat them as free funds in terms of the existing legal framework.

We have also noticed that the other reason why the demand is very high is because some of the money being taken from the banks is not circulating the way we want it to circulate.

It appears people are now holding the money much more than using it as a medium of exchange. So by holding the money, it means you are suffocating the system and again, that is the reason we need more currencies than one. So, these are the fundamental reasons.

And also because the demand is high because people are importing using the same money, because of low production in Zimbabwe and low production is caused by the fact that it is cheaper to import than to produce, so we do not have any real production going on.

It means you are forced to import so as to fill the gap of demand goods that are required in Zimbabwe. So we, therefore, need to come up with policies that address those fundamental principles and deficiencies in the system. that’s why we came up with those policies.

BZ: But people are raising serious concern with the issue of bond notes and the RBZ declaration that they will be 1:1 with the US dollar. I have even read some articles saying Zimbabwe is printing its own US dollar.

JM: I think people are missing the point. The point is that we have established a facility from the African Export Import Bank (Afreximbank) of $200 million which is supposed to be used for stabilisation of the foreign exchange market and also to provide incentives for people who are bringing foreign currency to Zimbabwe. There is going to be an incentive facility of 5% on all foreign exchange receipts, including tobacco ad gold sale proceeds.

BZ: If you may expound more on the Afreximbank US$200 million facility.

JM: It’s more like the gold standard, people forget too much in this world; in America where you are, there was a gold standard up to 1971, which means there is a backing facility, so this $200 million is backing the notes, and just like the bond coins that were backed by a $50 million dollar facility and they worked very well.

We are using the same analogy for a similar scheme. In fact, the notes are a continuation of the bond coins. While the coins were for competitive building exercise, using them so there will be sub dollar prices in the market for change, this one is for stimulation of exports, to ensure that at the end of the day, Zimbabweans do go back to do their business and get a value and that value convertible into the US dollar because they bring money into Zimbabwe.

BZ: So what it also means is that the government cannot print anything more than $200 million right?

JM: That is exactly what we are saying, if something is backed, it means you cannot go above the facility . . . In fact, we are not going to print more than that. This is to ensure that the liquidity situation in Zimbabwe, the nostro accounts are also funded, money from the nostro account will also then fund these notes, so there is a limit, and we cannot print more than that. Why do people think we are careless?

BZ: And there are some who are saying well, what the central bank chief is doing is re-introducing the Zimbabwe dollar through the back door?

JM: My response is very simple, the taste of the pudding is in the eating; number one. Number two, when we introduced the bond coins they said similar things. So, it’s not a surprise and thirdly, we sympathise with their thinking processes, they are living in the past.

They think like that because we went through hyperinflation… . But they should trust that we also know what we are doing, and that we believe that Zimbabwe needs to transform and that this economy needs stimulation. And that this economy requires exports and production, so where there is no production, the economy will not do well, so we want to ensure that there is production.

BZ: Is there an exact date when the bond notes will be unveiled?

JM: As I said yesterday (Wednesday), the bond notes take a bit of time because we need to do the designs, we need to give the company that is doing the printing time, and that company might have orders in the pipe line and so we are looking at plus or minus two months.

BZ: Is this being done in Zimbabwe (the printing)?

JM: No, no, no. It can’t be done in Zimbabwe. I said many times it’s done outside, just like the bond coins, they are all done outside.

BZ: In Germany?

JM: I did not say that, but it’s in Europe, I did not say where.

BZ: Have you been consulting business about these policy changes?

JM: Oh sure, the business community was very much involved in crafting these reforms. It’s only people who are in the diaspora who always feel they are being short-changed. I noticed they rely on the social media and come up with their own theories.

I do not blame them, maybe they are far away from home and assume there are queues at all banks, but actually there are only four banks that had issues actually.

The business community and the banking sector are actually happy.

We consult them. In order to promote efficiency utilisation of foreign exchange and to re-orient import demand towards productive uses, the Reserve Bank and the Business Council as represented by the Confederation of Zimbabwe Industries (CZI), Zimbabwe National Chamber of Commerce (ZNCC) and the Bankers’ Association of Zimbabwe (BAZ) have come up with the foreign exchange priority list to guide banks in the distribution of foreign currency towards competing demands.

BZ: Let’s talk about cash limits?

JM: Yes, to be compliant with international best practices, with immediate effect, cash withdrawals will be limited to $1 000, €1 000 and R20 000 and the maximum cash allowed to be taken outside the country has been revised downwards from $5 000 to $1 000, €1000 and R20 000.

BZ: The use of the electronic payment system in Zimbabwe is very low compared to other countries, what is the central bank doing about this?

JM: We have put a number of measures to use plastic money because that is the way to go. If people use plastic money or transfer though RTG’s, it means the demand for cash will go down.

But Zimbabwe is predominantly a cash economy, people believe in ownership, they want to say the money is mine, let me keep it in my pocket. I think it’s a historical problem or maybe it’s the traumatic experience they went through in hyper-inflation, but in Africa and in other parts of the world there is a high demand for usage of cards… but here it’s a cash economy.

It’s a paradox, people want the cash, and they do not want to use plastic money and or even bank it.

The traditional savings culture, where the banking public used to deposit money for a specific return has been eroded over the years, thereby undermining the savings culture in the country. This has affected the economy in a negative way.

BZ: But what about government institutions, they are not using point of sale machines too?

JM: All utilities and municipalities are also mandated to promote the use of plastic money by installing the point of sale (POS) machines in their banking halls. This requirement also applies to government departments and public entities that provide services on cash basis to the public, such as Ministry of Home Affairs’ Registrar-General Department (passport fees), Zimbabwe Road Authority (toll gate fees) and government hospitals.

We have also said schools, hospitals, everywhere, let’s use point of sale machines, so we are trying to revolutionise plastic money in Zimbabwe. To this end, every business in all geographical areas and sectors of the economy must have a point of sale per till machine or purchase point.

We are also urging the banking sector to work towards increasing the quantum of POS machines.

There are currently over 17 000 POS machines in the country, but they are concentrated in urban areas, mainly Harare and Bulawayo. We are encouraging every business in all geographical areas and sectors of the economy to have a POS per till machine or purchase point.

BZ: And some economists are saying why not join the Common Monetary Area (CMA) or the South Africa Rand Multilateral Trade Area? JM: Zimbabwe’s cash economy problems will not be resolved by that. Besides, joining that CMA, is not automatic, there are many steps that are to be taken. We are in a multi-currency system and we are happy with it.

BZ: So what are these intervention measures meant to achieve?

JM: We expect these measures to go a long way in easing the cash shortages and at the same time reducing import dependence through promoting local production. The central bank is committed to ensure stability of the monetary system, which is necessary for sustained economic growth.—VOA