The introduction of bond notes by the Reserve Bank of Zimbabwe (RBZ) has brought more misery than relief to depositors that now have to endure longer queues to access their cash.

By KHANYILE MLOTSHWA/ NQOBANI NDLOVU/VICTORIA MTOMBA

A top RBZ official disclosed that some banks had by Friday run out of bond notes but immediately ruled out an injection of an additional batch of the local currency.

As if the snaking queues were not enough, banks started rationing cash a few days after the RBZ injected $10 million worth of $2 bond notes and $2 million $1 bond coins.

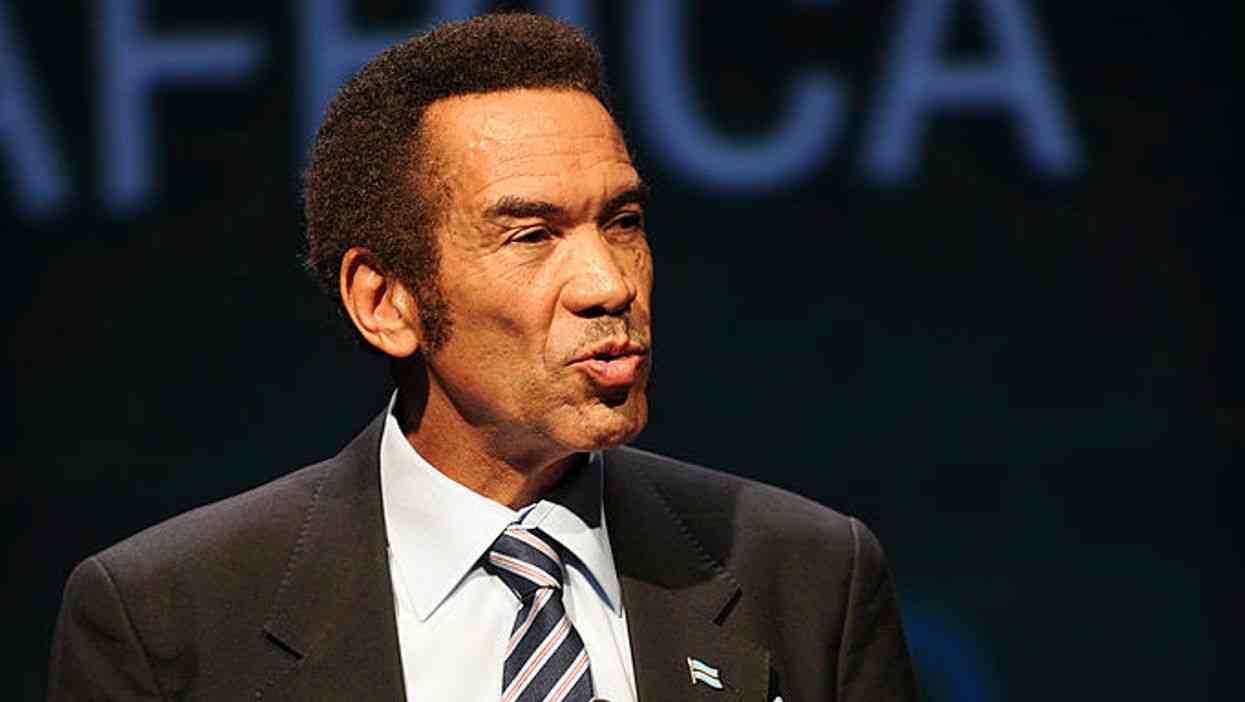

The crisis forced RBZ governor John Mangudya to go back on his statement in May that the bond notes would ease the cash crisis that started to intensify late last year.

On Friday, Mangudya insisted the bond notes were not being introduced to solve the cash crisis and added that the RBZ would not be stampeded into pumping out more of the surrogate currency to meet demand.

“I have said we will drip feed the market with the bond notes, don’t tempt me [to put more of them into circulation]. We need to do the right thing,” he said.

“We need to assess the utilisation of each batch that we bring to the market.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

“We never brought bond notes for easing the cash crisis but they are an export incentive.”

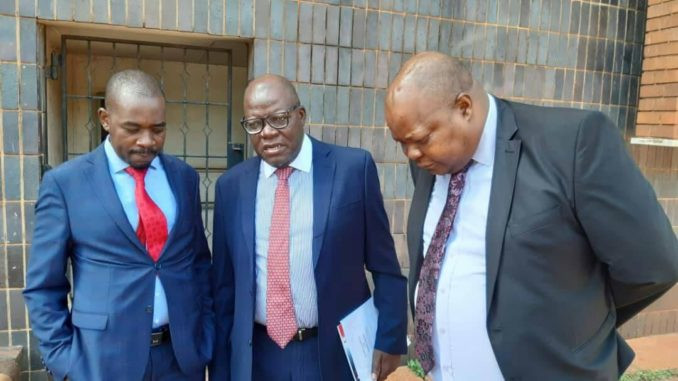

One of his deputies, Khupukile Mlambo told a public meeting in Bulawayo on Friday that banks had run out of bond notes.

“Local banks have run out of bond notes,” Mlambo said. “We only printed $12 million worth of bond notes, but the banks have been calling us requesting for more [bond notes], saying the ones they had had run out.”

The meeting was jointly organised by the Bulawayo Progressive Residents Association and National Youth Development Trust.

“We are in discussion with banks on what we can do about this situation, but what I can tell you for now is that banks are saying they do not have bond notes,” Mlambo said.

He insisted they could not “just” print and circulate bond notes worth $75 million into the market to ease the cash crisis.

“The reason why we cannot just print more and give the banks using that guarantee credit facility from African Export Import Bank [Afreximbank] is because we want to gain your trust and confidence,” he said.

“We want to do things differently. We do not wish to go back to 2008 and print money for the sake of printing money.”

Mlambo said the country’s problems were huge and could not be easily solved by the introduction of the bond notes.

“The bond note is not here to solve all your problems,” he said. “Even the US dollar can’t do that. Your problems are deeper than that. Our economy is currently going through a difficult phase. The symptom is the shortage of cash.”

Mlambo said the balance between exports and imports was skewed in favour of imports, which was causing liquidity challenges.

“We are consuming too much [imported] goods,” he said. “Every time you buy something that is imported, you are sending money out of the country. I am talking about the legal ways [money moves]. The spending of the government is very high, especially on paying civil servants.”

The bond notes are backed by a $200 million Afreximbank guarantee credit facility, not a loan from the institution, Mlambo said.

Meanwhile, some banks that were allowing depositors to withdraw US$50 and $50 in bond notes a day had halved the allocation by the end of the day on Friday.

Others had stopped servicing clients altogether as they had run out of cash.

Major banks also had a nightmarish week as they had to suspend the use of automated teller machines (ATMs) as they were not configured to dispense the bond notes, resulting in meandering queues at their branches.

MBCA, one of the leading financial institutions that had not yet witnessed the long queues that force some depositors to sleep outside banks, admitted it was facing a crisis in a statement to its customers on Friday.

“The national cash challenges have resulted in long queues across the banking industry and we are beginning to see the same queues in our branches,” MBCA MD Charity Jinya said in a statement.

“We plan to disburse bond notes via ATMs for our individual clients and serve cash in branches.”

RBZ blames the cash crisis on the alleged externalisation of the US dollar and a high import bill.