THE Reserve Bank of Zimbabwe’s drive towards a cashless society has taken a battering following the introduction of bond notes last week, with some traders, including fuel dealers, rejecting debit cards.

BY VICTORIA MTOMBA

Thousands of people were last week left stranded as fuel dealers and some shops rejected plastic money, which the RBZ strongly believes is the panacea to Zimbabwe’s intensifying cash shortages.

Prior to the introduction of $1 and $2 denominations of bond notes last Monday, plastic money transactions were relatively smooth.

A hardware shop in Harare’s central business district on Tuesday, a day after the introduction of the bond notes, told customers that it was no longer accepting debit cards but did not give any reasons for the decision.

Most service stations were also not accepting debit cards, saying the network was down, while others were charging higher prices for non-cash customers.

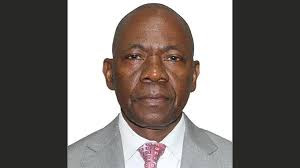

Confederation of Zimbabwe Industries president Busisa Moyo said one of the reasons fuel dealers were rejecting plastic money was that their bankers were under pressure to get cash.

He said some financial institutions were now treating customers using the Real Time Gross Settlement (RTGS) platform and plastic money differently from those using cash.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

“RTGS and plastic money are not being ranked at the same level as actual US$ notes and coins,” Moyo said.

“As pressure on liquidity mounts and nostro balances get lower and lower, most companies will be pressured by the banks to deposit hard cash.

“Secondly, some opportunists are now buying large quantities of goods before selling them at a discount for cash.

He added: “Thirdly, as there is perceived uncertainty around bond notes and the misunderstanding around the same, many businesses see cash as a secure position until the dust settles around convertibility and wider acceptance of the bond notes.”

Harare-based wholesalers were rejecting debit cards from customers that wanted to buy commodities such as sugar and cooking oil.

Some retailers are now also demanding that customers that want to make use of the cash-back facility buy more.

A leading retail chain now demands that customers seeking $40 should buy groceries of up to $20.

Other companies are also charging dual prices for cash-paying customers and those using debit cards.

Since the beginning of the year, the RBZ has been encouraging Zimbabweans to switch to plastic money as the country witnessed cash shortages.