A boom in the international price of chrome has seen foreign companies scrambling for chrome claims in the country, Standardbusiness has learnt.

BY FIDELITY MHLANGA

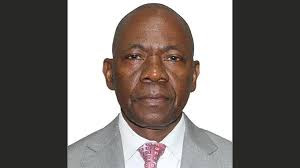

The ministry of Mines is currently clogged by enquiries from prospective investors in the chrome sector, deputy minister Fred Moyo said last week.

“The price is good and this is evidenced by the number of foreign companies that are scrambling for our chrome now. Everybody is looking for our chrome right now. So it tells you that it’s doing well. In the short-term, these companies want to buy ore. Remember we said ore can be exported but in the long term, our underlining principle is one of beneficiation. So they also then set-up plants. So there is a lot of interest,” he said.

Moyo said it was critical for Zimbabwe to take advantage of the prices of ferrochrome and avoid bureaucratic processes and move with the times in order to accommodate chrome investors.

“There is a lot of work that has to be done quickly. The prices of ferroalloy are very high. If we don’t take advantage of the price boom, we are going to lose out again. Remember gold went up to $1 800 per ounce but at that point we could not capitalise because our companies were struggling moving from the Zimbabwean dollar to the United States dollar,” he added.

According to a mining markets and investment website, InvestmentMine, ferrochrome prices grew by 27% to $2,29 per kg as at the end of March, from $1,80 per kg in April 2016.

Moyo said there was a “company which had indicated that by November smoke should come out of the plant. Can you imagine if we fail to give them a licence?”

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Government has been idle in discussions with companies to cede claims. Zimasco has already done so and discussions are underway with ZimAlloys to do the same with a view to deliver them to small-scale miners and smelters.

“The point is to take the land and take advantage of the boom. It’s a question of ZimAlloys offering 50% as required by government, but they were offering slightly less,” he said, adding that the claims were earmarked for small-scale miners and smelters.

“Smelters can take claims which require big equipment. They can also go underground but for small-scale miners, their capacity to go down is limited as they have deep-seated claims.”

Economist Clemence Machadu said Zimbabwe could benefit from the ferrochrome rally mainly driven by a swelling demand in China.

“In terms of capacity, the numbers on the ground already point to surging capacity. Ferrochrome exports in the first two months of the year were 297% higher, compared to the same period in the previous year. In fact, this year’s January to February ferrochrome exports in value, represent over a third of the entire ferrochrome earnings of last year,” he said.

“January ferrochromium exports represented 10,1% of total exports for the month, with the ratio rising to 11,2% in February, which shows that the mineral’s contribution to exports is gaining.”

Machadu said the distribution of unutilised chrome claims, coupled with the lift of the ban on chrome ore exports, “means that more chrome ore volumes will be realised, which guarantees raw material availability”.

He said if smelters sealed the uninterrupted power supply deal, it would foster consistency in production, raising chances of doubling ferrochrome production this year.

Machadu said there was need to capacitate local smelters to have state-of-the-art equipment and revamp the country’s road and rail infrastructure.

“The only worry is the current installed smelting capacity of our local smelters and the obsolete and antediluvian state of some of their equipment. Another issue of particular concern is the state of our road infrastructure, especially after the La Nina floods which destroyed the roads; with rail also not being that impressive. Our proximity to the market is not favourable, which calls for very efficient and cost-effective transport systems,” Machadu said.

Another economist, Prosper Chitambara weighed-in, saying government needed to expedite the ease of doing business reforms, as well as simplifying the mining tax legislation so that investors get a return on investment.

“We can benefit through this chrome boom. All we need is to address the ease of doing business issue so that investors get returns. We also need to address the uncertainty. Tax regime needs to be harmonised and simplified. Our taxes are not pro-business. The tax regime in general sends a wrong signal and that is why there has been tax avoidance and evasion in the mining sector,” he said.

Zimbabwe holds the second largest chrome ore reserves after South Africa.

In April 2011, Zimbabwe banned the export of raw chrome, urging companies to beneficiate the mineral into ferrochrome. The move failed as companies struggled due to lack of smelting capacity, high production costs and power shortages.

The ban was lifted in June 2015.

The freeze led to the country accumulating 77 000 tonnes of chrome ore.