Zimbabwe’s inability to undertake structural reforms will scupper access to cheap lines of credit from multilateral financial institutions, analysts have warned.

BY BUSINESS REPORTER

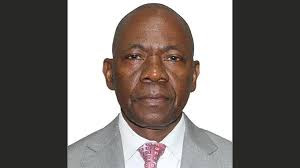

On Friday, Finance minister Patrick Chinamasa said the terms and conditions of the facilities that the Reserve Bank of Zimbabwe had put in place to clear arrears to the World Bank and the African Development Bank had been scrutinised and adjudged by the affected international financial institutions.

He said they were found to be reflective of current market conditions, with financing terms similar to market transactions recently concluded by several sub-Saharan African countries during 2016 and 2017.

Chinamasa said the clearance of the debt arrears was expected to attract foreign direct investment in the short to medium and long term.

He said the clearance of the debt arrears would be accompanied by the ease of doing business reforms, improvement of investment climate, fiscal and current account deficit containment and reorganisation of state-owned enterprises.

While lauding the breakthrough, analysts said bold reforms were key as part of the country’s re-engagement process.

Economist Daniel Ndlela said with the upcoming election, the question was, could Zimbabwe afford to reform when it is known to “cut corners every time it faces an election”.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

“There are loaded upfront reforms required before elections. That is a mammoth task,” he said.

Former Finance minister Tendai Biti said Zimbabwe had no capacity to borrow and repay any loan.

“Zimbabwe can’t afford to borrow from X and pay Y. Repayment of the debt is not enough without reforms, which this government has not done.

“Without reforms, this economy will continue in this disequilibrium, de-industrialisation, over-expenditure and totally skewed current account,” he said.

“Zimbabwe is poorly managed and not in a position of borrowing from anyone.

“We can’t pay salaries. So when we can’t run our economy, how then do we borrow?”

Economist Ashok Chakravarti said while he was not privy to the exact terms, the condition precedents had been economic benchmarks.

“Even in the case of the IMF, you will recall, the economic benchmarks had been met by Zimbabwe a long time before they actually made the payment of the arrears,” Chakravarti said.

An indication that the Zimbabwe government is not likely to bend backwards to satisfy reform demands is a recent declaration by officials in the ruling Zanu PF party to the effect that their party would “not reform itself out of power”.