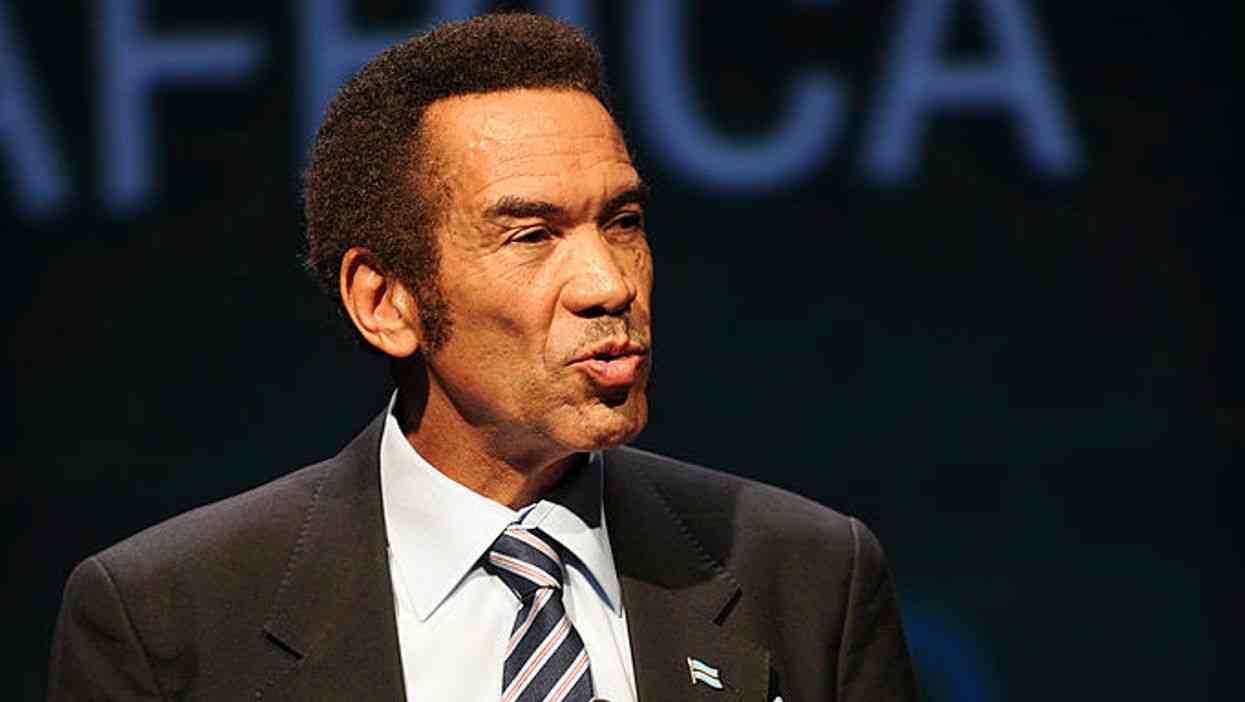

Reserve Bank of Zimbabwe (RBZ) governor John Mangudya says he has no power to stop the trading of bond notes on the black market.

BY OBEY MANAYITI

The bond notes have failed to end the cash shortages that are worsening every day.

Mangudya, who last year said he would resign if the bond notes experiment failed, said there was nothing he could do about the black market.

“The Reserve Bank is not an arresting entity, it is a regulator. You should ask the same questions to the people who are responsible for that area,” he said.

“RBZ is not an arresting entity and we don’t have those arresting powers.

“That question should be directed to the people in charge of law and order otherwise you are empowering me too much.

“I have got my limits and my limitations and one of the limits is that I don’t go that far.”

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Mangudya said Zimbabweans appeared not to understand the cause of the cash shortages in the country. He said Zimbabwe was not generating enough foreign currency to meet current demand.

“People should get the basics first. We are using foreign currency as the medium of exchange and the foreign currency needs to be earned because it is not printed by the RBZ, therefore, we need to export our gold, our tobacco and chrome to get this foreign currency,” he said.

“We then import that cash to bring it into the economy for people to use but the same foreign currency is required to meet the requirements for industry.

“This is a balancing act and what does that mean? Do we import more cash against not importing raw materials?

“Do we import fuel or we import cash? There is a competing demand for the foreign currency that is the issue.”

He said the RBZ had scouted for a $600 million stabilisation facility, which would be extended to Zimbabwe soon.

Mangudya said the central bank was supporting exporters so that they could earn the country more foreign currency.

The RBZ boss emphasised the need for discipline in the economy to address some of the problems Zimbabwe was facing.

“We are asking for self-discipline on our economy,” he said.

Zimbabwe has been battling cash shortages since 2015.