Econet Wireless, and all its subsidiary companies in Zimbabwe, is now paying staff through EcoCash Payroll to spare its employees the hassle of spending time in long bank queues.

BY OWN CORRESPONDENT

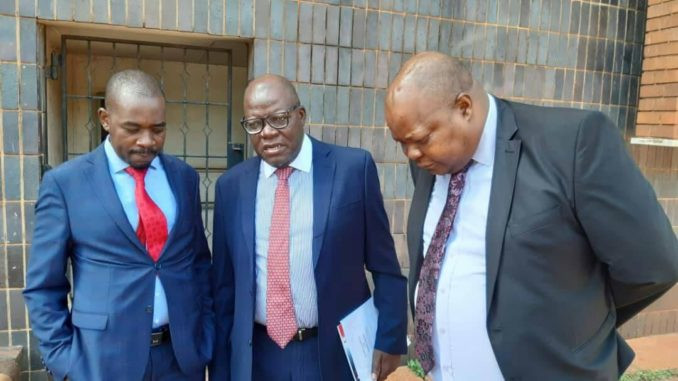

The telecom and technology company’s group CEO in Zimbabwe, Douglas Mboweni, said the decision to pay Econet staff salaries through Ecocash Payroll was intended to offer convenience by taking its employees out of long bank queues, in view of the current cash shortages.

EcoCash Payroll involves the use of EcoCash by a company or any organisation to pay its employees’ salaries of wages.

“Our observation has shown that disbursing staff salaries through banks forces them and their families to spend long periods of time standing in bank queues to access their money,” Mboweni said.

“Whereas if we disburse it directly to them, via Ecocash Payroll, they can decide for themselves how much they want to transfer to their banks.”

He said because EcoCash alredy offered banking services, employees could automatically move funds to their bank wallet, without having to queue in the bank.

He added that EcoCash Payroll had already been adopted by a significant number of companies in Zimbabwe, including some that were listed on the Zimbabwe Stock Exchange.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

In addition, micro finance institutions were also dispersing loans through EcoCash.

Mboweni said bank queues could be significantly reduced if other organisations followed Econet’s example, adding that it would also ensure organisations did not lose vital productivity time in queues.

EcoCash has been making efforts to help people get out of long queues by deploying its brand ambassadors to educate them on the convenience of using EcoCash.

The ambassadors also help people in queues on how to move their money and make payments using mobile phones.

Mboweni said “cash holdouts”, where people are forced to pay only in cash, needed to be eliminated.

He said there were many merchants and businesses that still demanded that people pay only with cash.

“This is unhelpful in the current situation in our country, and it forces people to spend their precious time looking for cash,” Mboweni said.

He said EcoCash continued to provide convenience to many people in Zimbabwe due to the current cash crisis.

“For example, payments to farmers are being done using EcoCash – to the Grain Marketing Board, Cottco and the tobacco auction floors and to much of the agro and processing industry.

“NGOs have also been using Ecocash for the past four years to carry out aid-related disbursements to individuals, in mostly rural areas,” Mboweni said, adding that the use of EcoCash Payroll was simple, safe, secure and reliable – with none of the risks associated with moving large sums of money.

Mboweni said in order to build on the ecosystem, EcoCash had signed up over 50 000 active merchants and agents – ranging from large retail organisations, to small informal traders – where the use of EcoCash has been widely adopted.