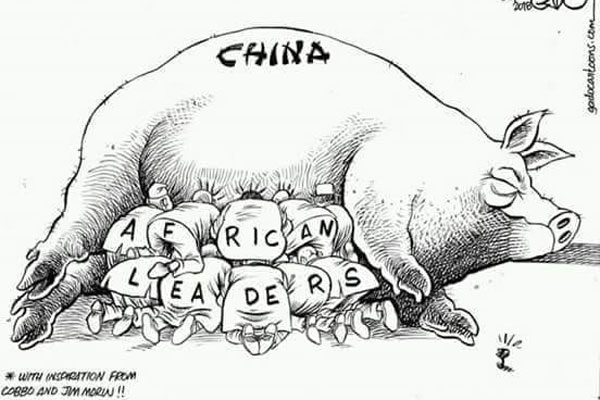

If there is going to be a compelling case for Chimurenga III in the future, it is because Zimbabwe would have been mortgaged by current leaders to China. In the past seven days alone, I have read at least 22 disturbing articles on Chinese predatory loans to many developing countries. Equally disturbing was the recent meeting held in Beijing at the beginning of September where African heads of state met with Chinese President Xi Jinping, where he pledged $60 billion in financing for projects in Africa in the form of assistance, investment and loans.

the sunday maverick with GLORia NDORO-MKOMBACHOTO

AP News reported that Xi said the figure includes $15 billion in grants, interest-free loans and concessional loans, $20 billion in credit lines, $10 billion for “development financing” and $5 billion to buy imports from Africa. In addition, he said China would encourage Chinese companies to invest at least $10 billion in Africa over the next three years. Xi tried to mollify concern that Beijing wants to build strategic influence, promising Chinese investment comes with “no political strings attached”. Xi ended by saying: “China does not interfere in Africa’s internal affairs and does not impose its own will on Africa.”

But China is no Father Christmas. Why would it give Africa a free lunch? By giving us loans, China is weaving strings with which to pull African countries when they default. By continuing to be a recipient of more Chinese foreign direct investment, Zimbabwe will play a bigger role in expanding China’s gross national product (GNP). In the end, the wealth generated by Chinese companies in Zimbabwe and the rest of Africa will be repatriated to China.

As China escalates its commitment to link the continent’s economic prospects to its own, Zimbabwe needs sharp and smart minds to navigate aid negotiations with the Chinese. If I could have it my way, I would advise that male decision-makers not be allowed in these negotiations alone without female minds for the sole reason that, generally speaking, males have a penchant for chicanery and corruption. The current state of Zimbabwe with a medieval disease like cholera ravaging parts of the nation is testimony to that.

In August 2018, United States senators David Perdue and Patrick Leahy wrote to secretaries Steven Mnuchin and Michael Pompeo expressing their “concern over bailout requests to the International Monetary Fund (IMF), by countries who have accepted predatory Chinese infrastructure financing”.

In that letter, the senators cited several countries choking on unsustainable debts to China, including Sri Lanka and Pakistan. In Djibouti, for example, “China provided $1,4 billion in infrastructure funding equivalent to 75% of Djibouti’s GDP, with the most recent IMF assessment cautioning that as the country increases its dependence on China, the benefactor will gain control of the Doraleh Container Terminal, further consolidating its influence in the critically strategic region”.

The US is the largest contributor to the IMF and simple logic prevents them from using their tax dollars to bail out gullible countries, who then use these funds to pay back China’s vulturous and extortionate loans.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

At the time of writing this article, the live worldometers.info indicated the Chinese population to be 1 416 186 482 and growing at the rate of a child every 2 to 4 seconds. This population is equivalent to 18,54% of the total world population constituting a population density of 151 per km2. China’s total land area is 9 388 211 km2 (3 624 807 square miles). Almost 60% of the population is urban (some 838 818 387 people in 2018) and with a median age of 37,3 years.

According to the 2017 China Private Wealth Report by Bain Consulting and China Merchant Bank, there are close to 2 million high net worth individuals (HNWI) who are dollar millionaires. The percentage of HNWIs with overseas investments increased to 56% in 2017, up from 19% in 2011, but the overall percentage of assets invested overseas has stabilized since 2013. The top destinations for overseas investment were Hong Kong, the United States, Australia and Canada. Respondents said their top three reasons for investing overseas were to diversify investment risks, to capture market opportunities of overseas investments and to migrate.

Many of those migrating to Africa are not necessarily HNWI. Many arrive with nothing and enter sectors with low barriers to entry, ordinarily the preserve of local entrepreneurs. In Zimbabwe they are competing with locals in selling airtime, brick making, food, retail, property development, farming etcetera. In property development they do not always follow municipal by-laws and continue as they please with impunity. Many more are in extraction mode getting preferential treatment from the political establishment. There is no Chinese bank in Zimbabwe. Neither do you find Chinese people in queues in a country with a serious liquid crisis. They import all their food and that is why you never see Chinese people in local supermarkets.

Africa is an attractive destination because of its abundance of resources like minerals, land and fresh water. In an April 2018 report by Mumbwa, sub-Saharan Africa has been short of people, not land. In 2011 the World Bank estimated that the region had 200 million hectares of suitable land that was not being used for crops — almost half of the world’s total, and more than the cultivated area of America. Yet Africa remains a net importer of food. This potential in Africa excites many. “Africa is the future breadbasket of the world,” says Ephraim Nkonya of the International Food Policy Research Institute, a think-tank in Washington, DC.” Mindful of this reality, the Chinese are systematically and deliberately expanding into Africa using covert and unorthodox means.

An August 2018 article in The Sun, written by Gerard du Cann confirms the “colonizing” nature by China by lending them massive amounts of money they can never repay. Creating business opportunities for itself and employment for its people, China ordinarily builds all their projects using imported materials from China, equipment and seconding technicians to the projects. China has defended its lending practices, saying they were “sincere and unselfish” and insisting it only lent to countries that could repay yet there are allegations that:

China intends to take over the Zambia international Airport for defaulting on its debt.

Lamu port in Kenya which was constructed by China on a Chinese loan of $16 billion, will see Kenya default in a few years and the biggest port in East Africa and adjoining towns will be handed over to China for 99 years.

In an April 2018 fin24.com report by Crecey Kuyedzwa, China reportedly wrote off Zimbabwe’s debt to China paving way for more funding to the southern African country whose ability to access new funding has been crippled by among other things a huge debt overhang. Why would China write off debt and then proceed to shower Zimbabwe with more debt? Those in the know allege that soon Zimbabwe will hand over a national asset.

The second scramble for Africa is well underway being led by China, the US and Europe.

In a September 2018 BBC report by Andrew Harding, entitled, Juncker, it unveils EU’s Africa plan to counter China, the EU Commission president has proposed a new alliance with Africa that could help create up to 10 million jobs in the next five years alone. Harding observes that Europe is emulating China’s approach to Africa — focusing on trade and on partnerships — not conflicts and charity. The EU’s proposal, among other things, includes:

The facilitation of African students to study at European universities

Help Africa improve the climate for business and increased financial assistance

Provide a total of $46 billion (35 billion pounds) in grants over the seven years from 2021

Certainly, money and not force is the new sword to increase the dependence on Africa for those who have it. Africans must remain vigilant. The current breed of African leaders making decisions whose impact will not affect them, are essentially mortgaging the continent’s future at a faster rate to the Chinese. The next wars are certainly going to be fought in Africa because of this reality. There is no Father Christmas neither is there free lunch out there from anyone, whatsoever. Zimbabwe needs to learn to cut its clothing according to its size. Without government looting and corruption, Zimbabwe’s economy can grow and thrive using the current natural and people resources it possesses.

Gloria Ndoro-Mkombachoto is an entrepreneur and regional enterprise development consultant. Her experience spans a period of over 25 years. She can be contacted at [email protected]