The big interview: IN CONVERSATION WITH TREVOR

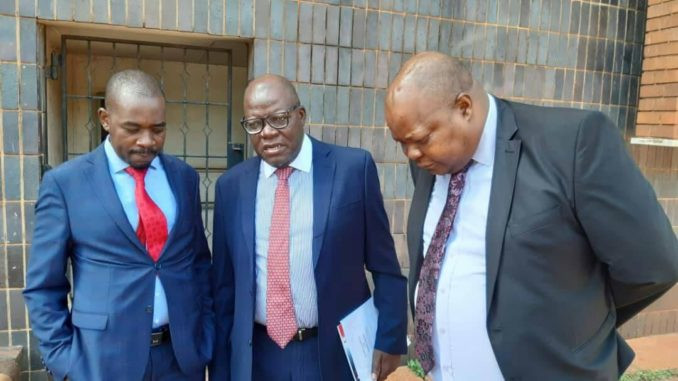

It’s almost a year since Finance minister Mthuli Ncube was appointed by President Emmerson Mnangagwa to help turn around an economy weighed down by decades of ruinous policies.

In the 10 months that he has been in charge, the former African Development Bank (AfDB) vice-president has overseen the abolishment of dollarisation, introduction of an unpopular 2% tax on mobile money transactions and a gradual removal of government subsidies.

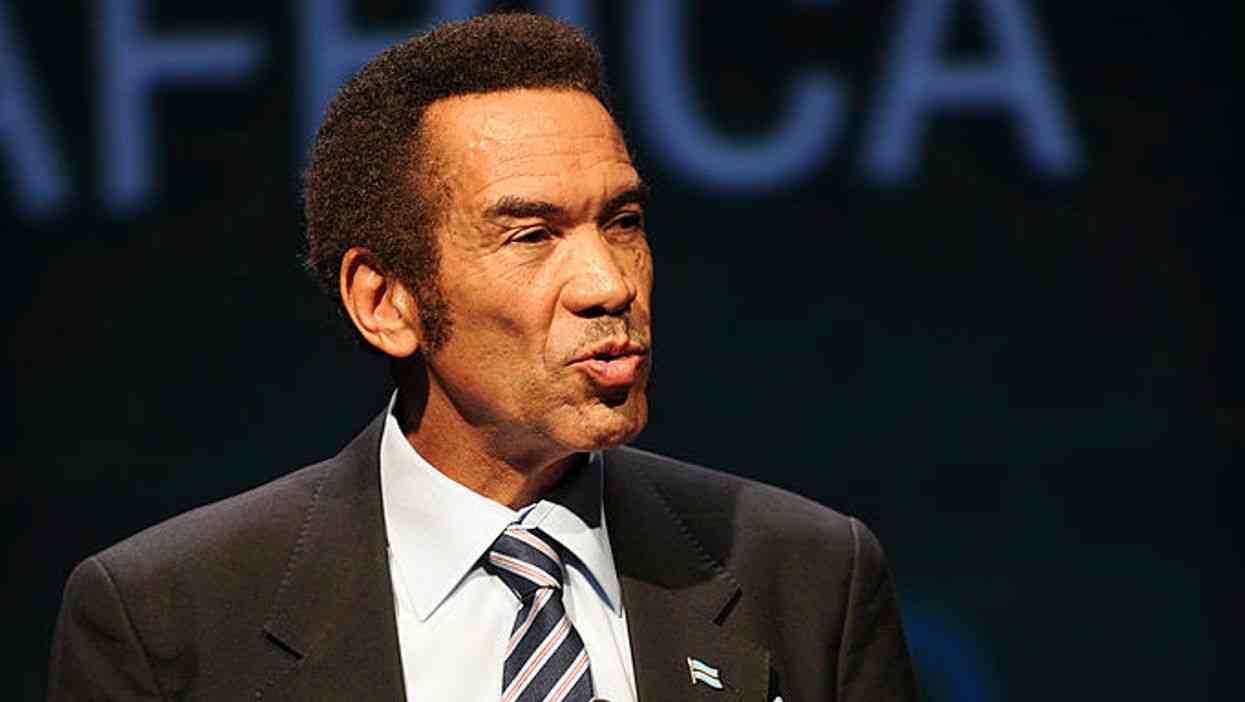

Ncube (MN) last Thursday became the first guest to be interviewed by Alpha Media Holdings (AMH) chairman Trevor Ncube (TN) on the forum In Conversation with Trevor.

He spoke about his reaction to his appointment, the policies rolled out by his ministry so far and what lies ahead. Below are excerpts from the interview. TN: Your appointment was a surprise to everybody, was it a surprise to you?

MN: It was a surprise to me, for sure, I was very comfortable where I was in private equity.

I was travelling between Switzerland and Oxford teaching students about how to do public policy and do business in Africa, MBA (Master of Business Administration), MPA (Master of Public Administration) degree students at Oxford and that is a private equity system, so I was very comfortable and they called came.

I thought this was a good chance for me to contribute.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

TN: First of all, what came into your mind when you got the call?

MN: What went through my mind was actually relocation. You know it’s never easy to relocate yourself and family.

From Zimbabwe, I relocated to South Africa, when I was busy being dean of this business school and enjoying all that, I had to relocate to Tunisia in the middle of all that; after a year into Tunisia there was a revolution (and) so many upheavals.

Lucky enough my family hadn’t been on board by then and after that I relocated to the UK and Switzerland.

So I had moved around a bit and I thought am I going to move again? But I thought this is going back home and I’m being given the chance to contribute and turn things around.

So after about a day or so, I was very upbeat.

TN: This is a tough job, given the environment and where you come from, why would you take such a job, minister?

MN: It reminds me, a week after, one of the finance ministers in the region gave me a call and said minister, I think you are the only minister in Africa, maybe in the world, who is going to have a real job.

I wake up every day and I feel I think I have a real job compared to my colleagues.

It is a tough job, but someone needs to do it, this type of job you need to be someone who understands complexity.

TN: Which brings me to the next point, you have been in charge for 10 months, what has been the biggest surprise for you?

MN: I think the surprise for me has been the extent of the deficit when I came in. I knew it was big, but not that big, and you can see what went through my mind when I thought about tackling it. Now you know where the 2% tax came from, when I saw the extent of the whole thing.

The other surprise was the adversarial nature of politics, especially in Parliament, that is all that surprises me, the shouting, finger-pointing, name-calling, which is always very unproductive. Those who know me, know I like to get on with things. I don’t want to spend time arguing, I hate that. I want to focus on something and get on with it.

TN: Your office is where politics meets reality, how have you been able to manage this?

MN: Initially I thought it was a finance job, then very quickly it became a finance-political job and most of the time it’s a political job because at the end of the day you have to recognise that finance follows strategy.

In government it follows politics, it is a political job and you have to juggle, you have to realise that certain demands are apolitical, a little bit political. There is a manifesto, there is a party in power and it has to deliver on what would have been promised.

So what I have to do now is to check on whether my budgets also speak to the manifesto, that is a promise to the people.

Luckily for me, what is in the manifesto of Zanu PF is exactly what I have in my TSP (Transitional Stabilisation Programme), so it works, but the pressures are there.

The other day I had to deal with rural political projects, which clearly have a strong political nature. I told myself, yes it’s political, but it’s about the people, the communities, they need to make bread, take the children to school, afford healthcare.

TN: Share with us, you have been unpopular for the 2% tax, some people call you Mr 2%, let’s deal with this 2%, that’s bold, that’s brave.

MN: I thought to myself, here is an economy which probably got the highest level of electronic money, probably overtaken by Kenya, that’s one before the RTGS dollar; number two, I have a deficit; number three, I have three and a half billion dollars, which has been collected by corporates, but not remitted to treasury.

What happened is that my predecessor had to approach the central bank and was using the central bank window to the tune of $3 billion, so that’s an additional debt as well; four, there is a huge informal sector, the economy has been informalised.

So how do I get the informal sector on board to pay their dues, and I thought the best is to use some tax based on the usage of electronic money. I get 100% compliance, everyone pays, you only don’t pay, if we say don’t pay.

Some people have been saying, minister, given that this works so well, why don’t you reduce other taxes and increase this one. I have been thinking about it.

TN: And what are you thinking about that?

MN: You know what, it’s very attractive and in my next budget I’m even mulling over that.

TN: So are you promising these guys tax reduction in certain areas?

MN: You know what they say, you must never announce policy in an interview. So I’m not promising them anything, but I am thinking about it, I am getting the compliance I need.

TN: Let’s deal with the insensitivity of the 2% where people are saying, yes, we see what you are trying to do, but you are hurting the people out in Siyaso and that kind of stuff, what’s your response to that?

MN: Well, maybe we have to see how we adjust our exemptions, it’s about exemptions, and we said that anyone with a transaction of about $10 and below should not pay a tax, clearly that has to be raised given the rate of inflation.

It’s not that we are insensitive, but actually, it’s an inclusive tax, to that extent we don’t want those that are not advantaged like you to pay, they shouldn’t be paying at all.

TN: So we now have a lot of exemptions, is that an ideal space to be in?

MN: I think so, I would say there needs to be some fine-tuning, there is one issue I may remove on exemptions in the budget, so there is still six months to think about it.

TN: Let’s move on, perhaps you have decided to do away with the multi-currency regime and introduced our Zim dollar, there is a lot of pushback. What was your thinking and what is the status of the policy initiative now?

MN: You know, I said it before we thought we had a budgetary constraint when we adopted the US dollar, but we didn’t.

We had a fiscal policy that was a risk to monetary policy and to the entire macro-economic environment, but when I got in, we managed to put the fiscus under control, then I realised that we were walking on one leg.

We also need the monetary policy, then we have a complete tool kit to also deal with the macroeconomic environment.

We have been on the journey towards currency reforms, we just didn’t tell you. We started on the 1st of October.

TN: So you didn’t panic, this was not a panic move?

MN: No, this was not a panic move and so on the 1st of October we separated the accounts as you recall and in January, we did a quasi-currency reform in the form of the fuel price and, of course, the reaction was, I would say interesting and then, on the 20th of February we introduced the interbank market exchange rate and formally abandoned the fixed exchange rate of 1:1 and on the 24th of June we introduced the domestic currency.

We have been on the journey. Maybe the issue is that we moved faster on certain things, slower on certain things.

If you recall my few interviews where I said we need a new currency and people couldn’t believe me, I was preparing minds. The president also gave similar signs, but, of course, you can’t negotiate a day when you introduce a new currency, you do it.

If you start to negotiate, people take positions, they speculate and that is what we were also trying to deal with.

So we needed to restore monetary policy as part of the tool kit.

Look at what we did on the day the Zimbabwe dollar was introduced, we pushed up interest rates to about 50% overnight because I was aware and I even know a specific company that I would not mention where they would borrow RTGS at the interest rate of 12% and go into the parallel market and take the money.

TN: Why don’t you mention the company?

MN: No, it is not right. Look, they were doing business, you know, so they used their strategies, but that strategy as they go about their business was wrecking the economy and my job is to protect everyone and it is the job of government to create a level playing field.

So we have unleashed the monetary policy as part of the tool kit and this will see us appoint a monetary policy committee, put it in place and then go and strengthen the interbank market.

We are quite aware that it needs fine-tuning, I am the first to admit that. But now we have a full tool kit.

Most people were surprised that I did not remove import duties on cars in US dollars, because that is an import management tool.

It is very effective. It is working very well because the current account deficit has shrunk substantially.

Why do we need it to shrink? Because if you go into your domestic currency, you don’t want your import demand to become a risk to the currency and cause volatility, so you tighten your fiscal side, the monetary side you unleash a full tool kit of monetary policy including interest rate policy; on the external front you then control import demand.

It is temporary, we are controlling the three pillars that are necessary to stabilise the domestic currency.

TN: How would you make sure that the value of the local currency remains where you want it to be and also the sense that the market is getting is that the interbank market does not exist?

MN: I would say that in terms of the interbank market, we are going to fine-tune and make sure that it really works, it is a process, it is a journey, and I don’t think we are there yet.

I am aware that the banks are running their own individual markets; they have got clients, so they match the clients with exporters and so on, and we know what is going on.

TN: But when will we have a national interbank market system and not individual banks running their own thing?

MN: We have an idea, we have a plan of how it works, I see the deputy (RBZ) governor standing up saying not now.

We need to fine-tune the market to make sure that it works. You should just go the bank and it offers you a rate, if you are an exporter or trying to pay school fees, we will get there. It is a journey.

There are countries that have gone through this like Nigeria, for example, or Egypt, they have gone through similar steps and we will get there.

You have asked about protecting the value of the currency, sorry for going deeper into economics, the value of a currency is driven by the following variables: it is your state of your fiscal position that is your fiscal deficit or surplus, it is basically the level of interest rates, the inflation, the deferential between yourself and the other countries, it is the growth in the money supply and then the state of your current account external balance.

The three pillars that I talked about and the variations determine the value of your currency.

As long as we keep a tight leash on these variables, we will be able to stabilise our currency.

The biggest of them all is that link between the fiscus and the money supply growth.

Because if you got a fiscal deficit, you have to monetise it to finance, so you issue treasury bills and that is what causes money supply growth. So if you look at the growth in money supply, it hasn’t moved much.

TN: You are happy on that side?

MN: I am very happy on that, but also in our Staff Monitoring Programme with the (International-Monitored Fund), one of our targets is the economic growth, is what we call growth in high- powered money.

We have a target, we are watching that target and as long as we watch that target, we are okay in terms of money supply growth and have a stable currency for some time in the near future.

You won’t see a runaway budget deficit under my watch. I have been very consistent, not under my watch.

TN: Let us have the minister speak to the issue of petrol and diesel, which in a huge way undermines whatever progress you are talking about. What is government doing in the long-term for both petrol and diesel and also power?

MN: I agree with you because the power situation is very serious, but the cause of it is weather. I don’t think we had fully understood as government the full impact of El Nino on water levels at Kariba Dam, so power generation has gone down drastically. In fact, it has halved.

Anyway, we have always been on a deficit as a country, so that is a major issue.

So what are we doing about?

I would say we have the short-term and the medium-term to the long-term.

In the short-term we have got into a serious demand management strategy. We need to categorise users of electricity, residential, industry, the corporates and manufacturing sector.

The mining sector, there is no reason why they shouldn’t pay tariffs that are linked to the exchange rate because these are earners of the foreign currency in the first place.

So we need a differentiated tariff structure, but also manage the demand side. We also have the issue of the supply management side.

Here I am talking about the hydro, the thermal and a bit of importation.

We can’t do much about the hydro now, but we can do much about the importation.

We have already done some ground work on this at the level of the principal, I mean at the president level, to enter into some financing arrangement for increased supply from the Cahora Bassa Dam, so we are going to get more power from there, and then Eskom, of course.

But still on power supply management, in the medium term not the current situation, is renewable energy.

I think we have been too slow in embracing renewable energy in Zimbabwe.

We have so much sunshine, but where are the solar farms?

I was going through an incredible video last night for the site in Morocco, one of the largest solar farms in the world; we have so much sunshine,why can’t we have solar farms here?

The other thing is that we have this (audit) report from PwC (PricewaterhouseCoopers) in terms of the goings-on at Zesa that needs to be dealt with.

The other issue is about the tariff, in US dollar terms the tariff is very low.

I have been in the past quoted as being unhappy about an automatic increase of the tariff, why? Because I wanted these three other things to be dealt with.

Let us understand the demand and supply of electricity, the internal issues in terms of the company and then when we have done all of these issues, we can then say we still need to increase the tariff.