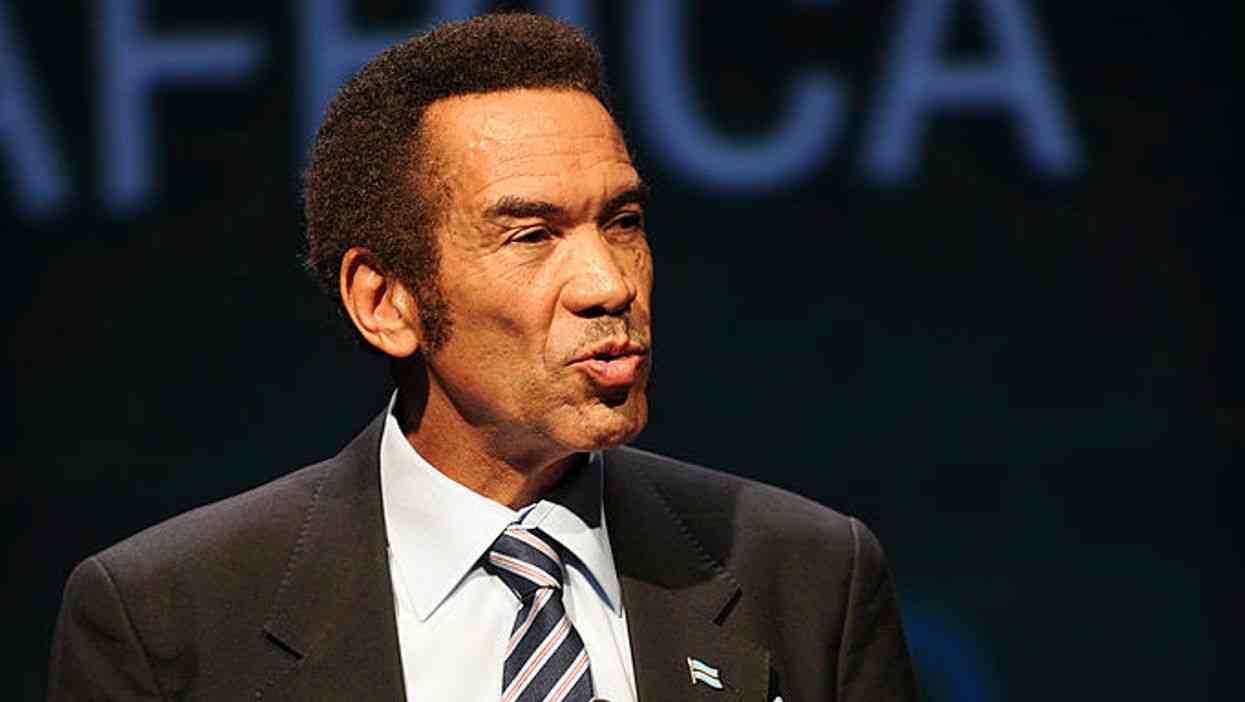

IN CONVERSATION WITH TREVOR

Zimbabwe’s dairy herd has declined to below 32 000 from a high of 192 000 in the 1990s, Dairibord Zimbabwe CEO Anthony Mandiwanza has revealed.

Mandiwanza (AM) told Alpha Media Holdings chairman Trevor Ncube (TN) on the platform In Conversation with Trevor that milk production had also gone down to 75 million litres from 260 million during the same time.

He described the business environment in Zimbabwe as tough, following a raft of currency reforms that have pushed the rate of inflation up. Below is the full interview.

TN: Your payoff line is “more than just milk” and yet a lot of people associate Dairibord with milk. Can you unpack what other lines of products that Dairibord is into?

AM: The genesis of Dairy Marketing Board as a state enterprise was to receive and process milk from farmers and produce the traditional milk, pasteurised milk and butter. That was the main line they produced then.

During the transformation from 1991 to 1994, we commenced a process of liberalising the dairy industry and let it play a fuller role than just processing milk. We then decided in 1997 to look outside the box and to see what other lines we could produce, exploiting the signage that existed in the factory through the process line. We came up with three key pillars of the business: the foods — which produces peanut butter, mayonnaise, and salad cream to mention a few. The second pillar is the beverages: products that are low milk-based including lines such as pfuko, cascade as the major lines in that category. The third pillar is of the traditional full milk-based products.

TN: Which line contributes the biggest to your business?

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

AM: The beverages are by far now the major contributor to our business portfolio.

TN: Looking at your results for the period ended June 30, 2019, how would you characterise that trading period?

AM: The trading period is split into two: January to the end of May, where we experienced both revenue growth and volume growth and to a larger extent relatively stable cost line movements.

After May, following the announcement of significant changes that took place, we saw the downturn in terms of volumes and revenues and we also experienced significant cost movement relating to the exchange rate and the scarcity of foreign currency.

The period January to May, we were very confident about the trading and trending, then from June onwards results represent a much more turbulent situation than was anticipated.

TN: So this is the negative impact of policy changes that have been made. You have got issues of currency, issues around electricity and also issues around fuel. Can you give us which one of the issues has had the biggest impact?

AM: In our line of business, we rely so much on electricity and producing short-shelf life products, which are extremely vulnerable to changes in the process line. Any interruption with respect to the supply of electricity results immediately in losses in process, and to a certain extent, compromising the finished products you want to put into the market. This issue is very significant in our business.

We also had another challenge of water supply. Traditionally we got our water from the municipalities who failed to deliver with consistency, resulting in us having to buy water for processing. Just to give you a sense of size, in the dairy industry, for milk and milk products and other products, we need a ratio of 2:1. For every litre that we process, we need two litres of water and we produced huge volumes in excess of five to six million products per month and that then tells you how much water we need. Can you now imagine buying most of the water you need during production instead of getting from the municipality?

TN: Where do you buy the water?

AM: There are quite a number of independent suppliers of bulk water and suppliers who buy it from Dema and other sources. It’s not a normal way of doing business, it’s absolutely abnormal.

TN: You still have been able to record pretty good results, which include volume growth, raw milk intake up from 14% last year to 22% this year. How have you been able to do so?

AM: An Increase in the intake of the critical raw milk is a result of a number of initiatives put in place to specifically focus on the milk supply development agenda.

We have invested significantly in human resources where we now have in all five of our catchment areas, resident veterinary surgeons working with farmers in that area to assist in animal husbandry and animal farming issues to enhance cost, quality and volume growth.

As a result of those initiatives, we have begun to see an increase in milk supply. This is a long-term investment, which is bearing fruit.

TN: What is the status of the dairy herd in the country?

AM: Let us go back to the 90s as our baseline, the country overall, produced 260 million litres of milk from the farmers annually. Today farmers are producing 75 million litres of milk, so you see the change in volumes of milk production from the national herd. The dairy herd was 192 000, but now is just under

32 000 and those statistics alone can tell you a huge change in the size of the dairy industry from that period to now.

TN: What would be the strategy to deal with the critical shortage of the dairy herd and the gap between demand and supply?

AM: We start from the supply side where the dairy herd can be lifted by looking into greenfield investment.

That means looking into bigger, high impact low-cost investment.

That can be achieved through a tripartite arrangement, which is government, private funding and corporate to supply the back-to-back agreement for the offtake of that initiative. If we do that, we will be able to produce big dairy producing tenders that will produce milk much faster within a shorter period of time.

Of course, for the gestation period, we are looking at about five years, but after that milk production will increase significantly. Experiences across the Zambian border indicate that approach to have seen fruits yielding.

TN: What is it that you would want to see government doing to attend to the shortage of milk and the growth of the dairy herd?

AM: On the growth of the dairy herd, government needs to attract private funding. There are a number of investment approaches by people who are willing to invest directly into the dairy sector, but what is required is the security of that investment.

If it is going to be a greenfield investment, there ought to be land available for that purpose and we see a number of catchment areas, one in the Middle Sabi, there is potential scope for a big greenfield investment that can be undertaken.

There is an interest from foreign funders to invest in such a project and that is where government comes on board to provide the comfort that you need on security needed, corporates to provide the back-to-back support for the milk production so that we can process and market it in the domestic and export market.

Import substitution and export generation is a critical component for that investment.

There is another potential area, which involves private players who are interested in going into a mega project along the same model.

TN: Is the government on board with this initiative?

AM: On the second initiative we were able to break ground with the Lands minister about a month ago. It has been encouraging and we hope to walk on that path.

TN: Would you encourage the youth to get into the market of dairy milk production?

AM: I would caution because there is risk of failure. We do not want to encourage a young entrepreneur whose little saving will be devoted to dairy and might lose out on their investment.

The dairy industry tends to be knowledge and financial-intensive with long gestation periods — those issues mean that the return on your investment is speaking to three to five years and young entrepreneurs may not have the patience to wait that long.

It is not to say that young people should not look at investment opportunities in that sector, as a company, we are available with our milk development unit to provide young entrepreneurs with the necessary skills and programmes and business plans that can be put in place to make sure projects do not fail when it comes to dairy farming.

We have already done some few projects with small-scale milk producers, but the progress is rather slow.

TN: How many have you undertaken so far?

AM: Well, currently in terms of our milk supply, 11% of our milk comes from small-scale milk producers who benefited from our heifer rehabilitation programme and that was successful to a limited extent, notwithstanding the challenges that I have already alluded to.

TN: Could we have more programmes that can allow young people to get involved?

AM: What you need is an integrated programme that speaks to starting with the genetics. The genetics must be appropriate.

TN: The results that we have on Dairibord reflect huge cost pressures on the business. You had an increase in revenue of 139%, but cost pressure of 123%. You still managed to make a profit of $12 million. Can you say some of those cost pressures eroded your earnings?

AM: These are two jaws. The bottom jaw weighed down the top jaw. The main cost driver is the exchange rate depreciation and you will see that the company had to pay in excess of $80 million that relates to the procurement of foreign currency at the depreciation of the exchange rate.

If we had not done that, we could have done better than at the level at which we recorded at the end of May.

The second one which is the cost of disruption, which I have already alluded to, electricity and water disruptions have been cost drivers; and, number three, the cost of packing material again relating to foreign currency and the internal inflation Zimbabwean factor. Those are the three main key headings, which weighed down our margins.

TN: On the other hand, you were unable to pass most of the costs to the consumer and, therefore, depleting your margins.

AM: Yes, ordinarily, in an inflationary environment when you increase prices of products it is normal. However, what is abnormal is the level of inflation, which is a countrywide problem.

As a company, it is normal to change prices, but we could not pass the full inflation on to the consumer mainly because of the erosion of the consumer purchasing power.

As a result, if we had passed the inflation to the consumer we would lose volumes and when that happens margins are eroded by the cost push, the result is worse than taking smaller and regular below-inflation price movements.

TN: You were still able to record an innate profit of $3,8 million compared to $217 000 last year, how did you manage that?

AM: As a said before, that it is the two jaws where the top jaw is your revenue moving at 139% and the cost moving at lower than the movement of your revenue, given that margin you have just referred to.

Over and above that, there is need to say that in an environment in which we are losing value due to depreciating of the currency, how do you preserve your balance sheet and shareholder value? There is need to restructure the balance sheet.

One is to invest in your inventory. We did a significant forward investment in January on our inventory, which hedged against price increases and we reduced our exposure from foreign currency from $4 million at the end on 2018 to about $1,8 million. We took a decision to source foreign currency, extinguish and expunge that foreign debt and obviously our minds were focused on what is the trend of the exchange rate.

As it continued to deteriorate if you remain as exposed as we were, it would eat big time into your profit and loss and into you equity.

TN: I see you have focus on the export market and the result there has also been quite commendable with 244% growth and your earnings from the export market to $1,2 million. How did you manage to do that?

AM: Our biggest revenue driver on the export market is our long-life milk, Chimombe, which is going into Zambia and Botswana as our key markets.

Secondly, our sterilised milk finds favour in Mozambique and Botswana, as well as Zambia.

Thirdly, we have our Quick Brew Tea going into South Africa, Botswana and Zambia.

Those are some of the key products lines we are exporting.

We also interestingly have foreign buyers who, during the time multi-currency was acceptable, would come to buy in bulk products like maheu to cross over to South Africa and we saw big volumes moving in that direction.

TN: Are you formally pursuing that market?

AM: We are now establishing a much more credible route to market via what we call distributorship and we have got a number of initiatives which we are working on so that we can establish a much more permanent presence in those markets. TN: So with this success that we have seen here in the export market, are there any other strategies to continue to grow into the region and perhaps internationally?

AM: Initially in 1997 when we were privatised, we adopted a growth strategy that looked into Africa and we invested in Malawi and Uganda, but we had to retreat from Uganda because when we look back we were a little bit clumsy in terms of spreading risk involving the locals and ourselves. We took a view that the winner takes it all and it did not work.

TN: I see that you are also disinvesting from Malawi, how far is that process now and why was it done?

AM: At the height of hyperinflation in the country up to 2008, the business unit that carried us was Dairibord Malawi because it was generating foreign currency.

We were able to generate foreign currency into Zimbabwe and change it into the then local currency and it carried the company.

Fast-forward over the past three years, the economy in Malawi has been experiencing foreign currency problems as we are. As a result, we were not able to repatriate foreign currency to Zimbabwe.

Secondly, reciprocally Zimbabwe is facing its own peculiar problems — we were not able to support that investment. As you know when a business has a subsidiary that has a little bit of “fever”, the parent company leverages its balance sheet to support its strategic business unit and get out of the problems. We needed to recapitalise the business and that has been the case since the last three years.

So we decided to cut our losses and run because we did not see light at the end of the tunnel.

The disinvestment in Malawi was completed end of July.

TN: Will you ever go back to Uganda and invest in the manner you did before with the lessons that you have learnt?

AM: I would approach it in a different manner. Your route to a market in the region is at two levels, physical investment and brand penetration. I think from a strategic point of view it makes much more sense to invest in your brands and when they are established you can then see the potential market in order to determine your investment levels.

What we did was a supply side push instead of being led from the demand side.

TN: Moving on to the business outlook, you are saying you are in survival and holding strategy, which means there are no activities to be carried out by Dairibord, but just holding fort to see what will happen. What are the key strategies you will be looking into as you are in that survival and holding strategy?

AM: The way we define the strategy is to accept that in Zimbabwe there are broader macro-economic challenges that we face and those challenges will weigh down the business and we are already experiencing that.

There is the reduction in consumer spending power, which results in volumes going down.

The survival strategy is how best you can hold your volumes at the current level to the year end.

This strategy cannot be done through a greedy model that seeks to hyper-inflate product pricing.

The business has to be able to accommodate everyone in pricing.

There is also need for alignment on the supply side of volumes and, therefore, the investment would be on the supply side to spend more attention in generating local milk production so that it fills in the twin strategic investment of import substitution and export generation. It is the complete value chain assessment so that we hold Dairibord.

In layman’s language, we hold the balance sheet value at what we pronounced it at half-year so that end of the year, the numbers remain as they were at half year.

The key cogs, which are granular issues, then speak to how you deploy your working capital, in terms of sourcing for inputs, imported raw packaging materials is that forward hedging is very critical.

Riding on the commodity prices to make sure that you strike when prices are at the lowest and invest your Zimbabwean dollars into foreign currency and procure the important material is important in the hold-and-survival mode.

TN: Are there any specific issues you would want government to attend to, to make you more bullish in your engagement so that you are not in hold or survival mode?

AM: The first key shakers and movers on business is the availability of foreign currency. When the interbank market was introduced, industry and business were very excited about the benefits that come via a credible price discovery mechanism for exporters and in turn a credible business mechanism to procure foreign currency. Fast-forward to the present day, we feel that the interbank is not working as efficiently as we anticipated.

There are over-arching issues with the first being the introduction of the interbank market without putting seed capital. it certainly does not result in the full efficacy of the system being realised by industry.

Secondly, you then have to address the issues of inflation vis a vis depreciation of the currency. Currently at government level, the challenge is where the foreign currency that we are generating in the country is going. There is need for transparency to address that issue because it then feeds into the confidence issue.

For example, if I knew that I would get all my foreign currency requirements, I would be very modest in picking up a price because I would not want to overburden my balance sheet with forward hedging. So, that foreign currency being generated by the country to the extent of $4,5 billion ought to be explained to the business community where it would be going and how it is benefiting the country.

Another monster in the house is the drivers of inflation, which are speculative behaviour. When people are not confident, they embark on speculation, so that is the biggest driver of inflation.

Finally, the issue of going forward requires a robust communication system so that we as businesspeople begin to see areas where progress is being made.

That communication feeds into the business sector, currently we are seeing distorted information.