LISTED clothing retailer Truworths Zimbabwe has over the years witnessed increased growth in volumes during the festive season due to high demand driven largely by civil servants who get their bonuses in November.

However, as discretionary spending continues to come down, the clothing manufacturer and retailer is facing a bleak festive season this year.

Truworths Zimbabwe CEO Bekithemba Ndebele (BN) told Standardbusiness correspondent Thomas Mupfuka (TM) in an exclusive interview that the outlook is gloomy.

TM: To what extent are you affected by the fact that your major clients, who are civil servants, cannot spend much because of their diminishing capacity to spend?

BM: We have three chains, Truworths which is your upper market, our mid-market Topics and then our mass market, Number One stores.

At Truworths, I would say 50% of our sales come from civil servants, then Topics it’s about 45% to 50% while Number One is a cash chain.

However, at the moment our customer base grew in the first six months of 2019, but the biggest problem is that disposable incomes and discretionary spending has actually come down.

Discretionary spending has come down because the currency has been debased — the result of debasing of the currency has been inflation and the incomes of the majority of our customer base has not gone up to match that debasement of the currency. So, people have to pay more for less.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

We have seen a decline in spending across our chain, but we are still strong on ladies formal wear because this market is still very formal.

The bulk of our sales are formal wear for both male and female.

Basically, we are likely to see sales in terms of dollar amount going up, and sales in terms of volumes are going to go down on last year.

We don’t see the trend that we have been witnessing before because it’s Christmas. The consumers are under pressure. The current mood is negative and people are talking about survival rather than lifestyle.

TM: What component of your sales are cash, and is there any scope to increase it?

BM: This year 34% of our sales have been cash compared to 30% last year.

We are targeting to increase our cash component, and some of the strategies we are implementing are that we are offering promotional discounts on cash sales and to move towards near cash sales, we are offering lay-byes that improve cash generation.

TM: What’s your experience regarding exchange rate risk and access to foreign currency given that you import a lot, but you have to sell in local currency?

BM: What we have basically done as a business when the bond notes were introduced was we took a view that we were going to pay all our imports upfront so that we would not carry the exchange risk exposure.

The signals were there, so when you pay for goods in advance what you have to worry about now is actually how you price the final product for replacement or for future consignments.

Access to forex has been a challenge. We are not part of the critical sector which gets priority access to foreign currency. When the interbank market opened, we managed to get forex for fabrics.

TM: How much foreign currency does your business required annually?

BM: On raw materials per annum we need US$500 000, for cosmetics and other accessories we probably need another US$400 000.

So, we say sustainably at the current trading levels a US$1 million per annum in terms of forex will keep us going based on current trading levels which are obviously depressed.

TM: What has been the impact of the current power outages on your factory?

It has been really bad. In September we actually had to shut down the factory for two weeks. We were powering those generators from 7am until 5pm.

So they broke down and we had to shut down to repair them and find fuel reserves as we were approaching our peak season.

TM: Any plans to diversify the business as a growth strategy given the dwindling spending power?

BM: In terms of diversifying out of clothing we are not going to do that. We don’t do anything else.

What we will do is grow the business organically to improve our products and improve our competitiveness.

As I said, the factory was a ladies factory, and since July, we introduced the men’s factory.

The in-house manufacturing, which is basically our backward integration is our growth strategy.

TM: Lastly, are there any plans to reduce trading space due to rising costs

BM: Shops won’t be shut down because of rising costs. Shops are shut down because of low trading densities. That’s when the shop is not turning over enough money to be profitable, but at the moment we have no reason to shut down.

We are still maintaining the same trading square metres.

What we did two-three years ago was that we rationalised our space.

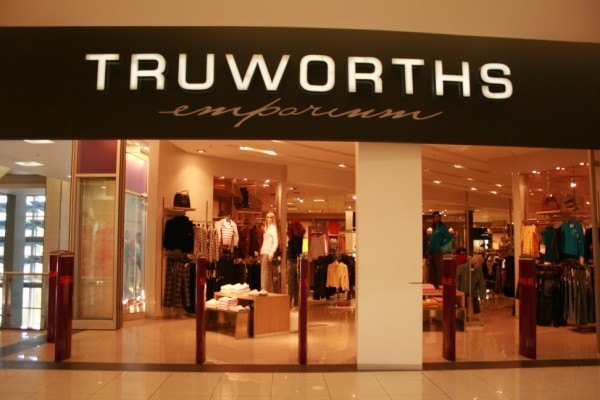

A good example is our flagship Truworths Men at Southampton, which we joined with the ladies into one emporium; we did the same in Gweru, as we are trying to consolidate space instead of giving up trading space.

The international trend is that shops trading space is getting smaller because of online services. It is no longer fashionable to have 1000 square metres.

If you look at Mr Price in South Africa, their strategy is to come down to 600 square metres per store.