BY own correspondent

During the half-year budget review, Finance minister Mthuli Ncube claimed government was on course to meet its budget deficit target of 1,5% of the gross domestic product and that he would not be seeking additional funding in 2020 since treasury had spent less than half of its budget and actually had a surplus of $800 million (US$10,42 million at the time).

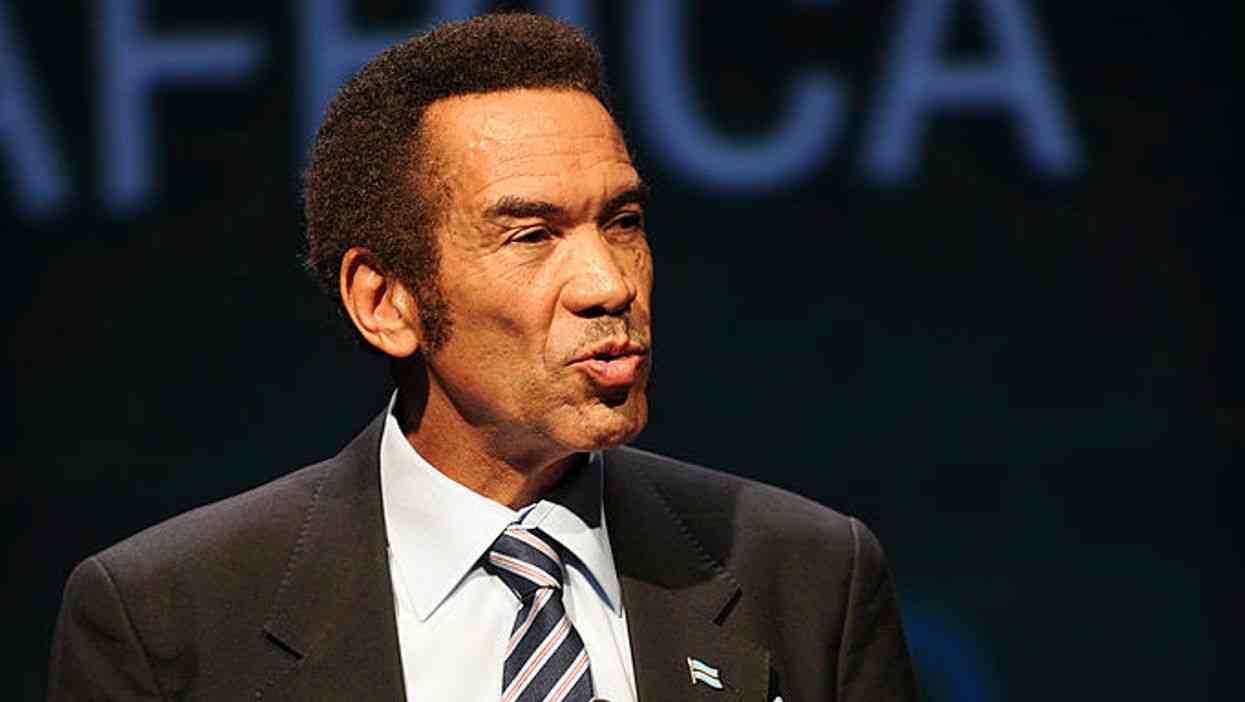

“I am still focusing on a budget deficit of 1,5% of GDP and we are well on our way to achieving that,” Ncube claimed.

Indeed, government has for the past months been telling anyone willing to listen that it has generated a surplus.

This is simply not true. The evidence of these falsehoods does not require any investigative journalism, merely an examination of documents published by the Reserve Bank of Zimbabwe (RBZ), which operates under the Finance ministry and has been, by its own admission, contracting debt illegally.

Treasury has merely stopped borrowing directly but has shifted this borrowing to the central bank, which is now engaging in quasi-fiscal activities in violation of section 49 of the Reserve Bank Act, which does not permit the central bank to borrow except against reserves.

The section was designed specifically to prevent dabbling in quasi-fiscal activities and requires the central bank to maintain, at the very least, a neutral balance sheet.

The opposite is happening.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

In July 2019, the RBZ had $23 billion in foreign debt.

The exchange rate at the time was 9,9, translating the debt to US$2,3 billion.

By July this year, when Ncube was making these claims of balancing the books, that foreign debt had jumped to $366 billion.

The exchange rate was 76,76, translating the debt to US$4,8 billion.

In one year, foreign debt increased by US$2,5 billion. For the avoidance of doubt, these are not exchange rate losses.

Where did the money go? Nobody knows. During his monetary policy presentation in February, RBZ governor John Mangudya said the central bank had “processed and validated blocked funds in an amount of US$1,2 billion from 730 applications out of 1 080 requests” as part of its policy to take over forex-denominated debt owed to foreign suppliers.

This would not explain the US$2,5 billion.

It also raises additional questions about the identity of the 730 applicants whose debt will eventually be taken over by taxpayers and the value of that debt in each instance.

There are understandable suspicions that the facility was created as a cover to further plunder the state, suspicions that could easily be put to rest by revealing the identities of the beneficiaries.

It is worth noting that in October 2017, the central bank’s net foreign debt stood at US$733 million.

Since the November 2017 coup, it has increased seven-fold to US$4,8 billion — a sharp increase that is at variance with claims that President Emmerson Mnangagwa is breaking with Zanu PF’s prodigal past and now running a disciplined government.

To grasp the full scale of what is happening, consider that the highest level of foreign debt Gideon Gono acquired during his time at the central bank was US$1,4 billion.

How is it possible that nearly double that amount has been acquired in under a year by a supposedly prudent government?

The Covid-19 shutdown in March 2020 saw the central bank’s foreign debt jump by US$1,7 billion to US$4,8 billion in four months to June.

Meanwhile, Ncube claims to be operating a Z$63 billion budget.

More importantly, since government claims it is operating within its Z$63 billion budget and by July had spent less than half of it, why was the central bank borrowing US$1,7 billion between March and June 2020?

What expenditure was the central bank supporting that is outside the budget?

This information is not in the public domain and we can safely assume that is because criminal activity is involved, why else would it be a secret?

Back to the Finance minister and his claims of balancing the books, it is clear that government has merely moved its obscene borrowings and opaque subsidies from treasury to the central bank.

This is despite the Finance minister claiming in his 2020 budget that he was removing subsidies on fuel, electricity and grain, saying they “led to large and often unpredictable expenses”.

If indeed the government has removed subsidies, as it claims, what is the central bank borrowing to fund?

The RBZ has no capacity to repay this ballooning debt and the public has every right to know exactly what this money is being used for as it is the public that will have to shoulder the debt.

Parliament, in particular, should demand answers because the central bank is clearly insolvent again, with negative equity of $360 billion, barely five years after the RBZ Debt Assumption Bill which saw taxpayers saddled with debts accrued from dubious quasi-fiscal activities such as the Farm Mechanisation Programme.

In that programme, equipment was freely given to Zanu PF supporters and functionaries and the central bank refuses to disclose the beneficiaries. There are no prizes for guessing why.

There are also potential implications for the lenders who seem quite happy to play along with these suspicious activities.

Afreximbank and other lenders have a responsibility to ensure that all debt to Zimbabwe is legitimate, without this they risk it being declared odious by future governments.

Afreximbank is particularly vulnerable given that it has allowed government to lie in its name, falsely claiming to have received a guarantee backing the value of RTGS dollars.

These numbers do not inspire confidence.

If the RBZ is having to borrow US$2 billion within six months just to keep the government going, how will it manage the next 12 months?

One cannot help but wonder if the RBZ has been borrowing to supply the foreign currency auction.

If this is the case, is the stability of the auction exchange rate sustainable?

The only way the central bank can repay these debts is either by printing money and going into the market to purchase US dollars, in the process driving up inflation, or mortgaging the country’s mineral resources.

The rate of borrowing is not matched with productivity and it appears the central bank is already under pressure as evidenced by its failure to pay gold miners on time.

Unsurprisingly, the authorities claim this delay is due to complexities involved in the importation of “physical notes”.

There are many complex problems in this world, importing notes is not one of them.