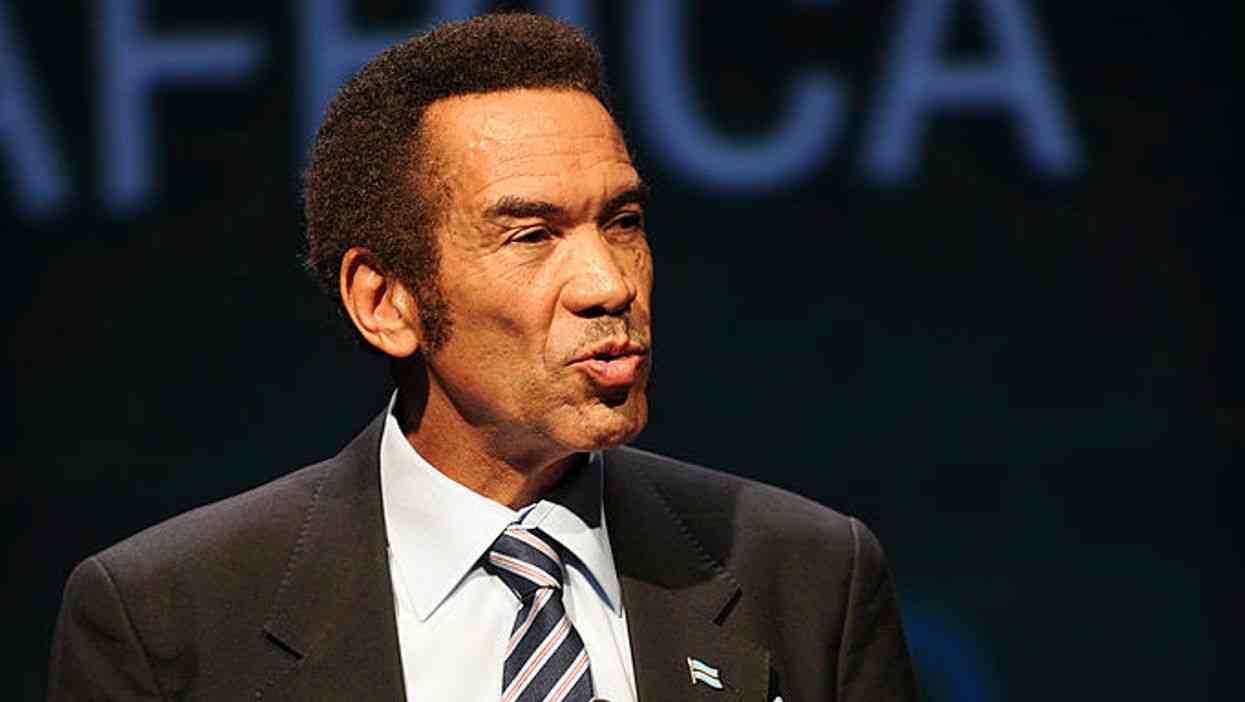

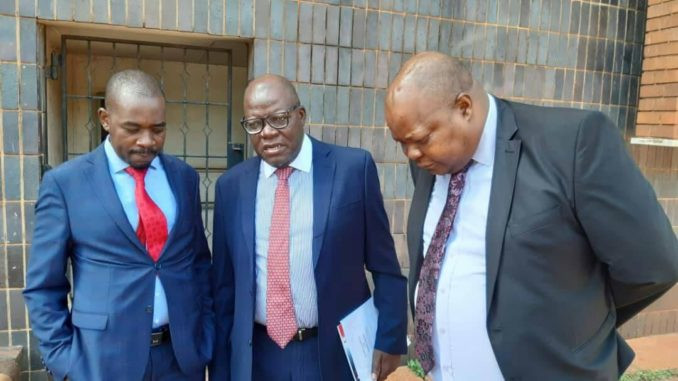

This week we had Justin Machibaya (JM), the managing director of Homelux Real Estate, as guest on ‘In Conversation with Trevor’, a weekly programme hosted by AMH chairman, Trevor Ncube (TN).

The interview revolved around Machibaya’s long journey to becoming one of Zimbabwe’s property moguls, beginning from the tight disciplinary regime set in the Machibaya household by Justin’s father, a former policeman in the Rhodesian BSAP, through a tough education process, a challenging entry into the world of real estate to the establishment of one of the country’s most successful real estate businesses. Below are excerpts from the interview:

TN:I consider you a property mogul; you have 26 years’ experience in the real estate business. Twenty years of that, you spent building your company, but I want us to go back to where you were born, where you went to school so that we find out what it is that goes into making a property mogul. Could you take us back… JM: Thanks, Trevor. I’m not quite sure whether that would build into the property mogul position now, but I was born in Bikita in 1969 and my father was a former BSAP. When he got out of the service, he then decided to look for a farm and I was three years old then. They bought a farm in Chivhu and they moved onto a completely open piece of land and they started building up this farm from there. Three years in Bikita, then the rest of my life in Chivhu; so I was raised by peasant farmers, very hard working. Sustenance came entirely from the farm. I did my primary school in Chivhu and I was not one of the privileged ones to go straight into boarding or to high school as one would say. I went to an upper top (low level, largely rural new secondary school built soon after independence in the early 80s) from Form 1 to Form 3 in Chivhu. I was walking some 10km to school and another 10km back. When we got back from school, you would sit down, get your meal and go to assist the parents in the fields and taking care of cattle. Form 4, that’s when I moved to Gweru for my O’Level and I got the shock of my life because at the upper top I used to be in the top three in class, but when I went to this high school my first composition, I remember very well, I actually got seven out of 20 and it was all red.

TN: The 10km to school, 10 km back, get home, you have a meal and off to work. That’s a tough disciplinarian upbringing, that which we don’t do to our kids anymore. JM: Very correct. Imagine dad being a former BSAP, discipline was his culture, so what he said should be done would be done. He allowed appeal, but there had to be a correct way of appealing and good grounds for it. In terms of discipline and the culture of working, I guess work is just natural to me. When you look at the generation today, yes, there is a gap; there is definitely a gap because the scenario is that being in real estate we go into many homes and often find kids sitting on the sofa, where they are served food by the maid, the plates taken away and cleaned for them… I think this kind of behaviour destroys the next generation. I believe God believes in people working. We are damaging our kids, I think, and we are creating a generation that does not understand or value work right from toddler ages. So, even when it comes to application of financial resources and/or kind of resource including talent, I see it treated in a casual manner, without seriousness or appreciation of the matter at hand.

TN: You are building people, building families in your pursuit in property; you graduated from the University of Zimbabwe with a Bachelor of Business Studies degree, you then decide to do a diploma in sales and marketing. JM: When I was at university, Trevor, my dream was just one, I considered myself a marketer and my dream employer was AirZimbabwe. For sure I did get an opportunity to go for an interview at Air Zimbabwe, but I didn’t get the job, and neither did they get back to me.

TN: Then your first job was as a sales manager at Alexander Court Estates, am I right? JM: That’s correct. I started as just a property negotiator and my first part was actually confined to high-density properties only, which I served so well. I think on average I would sell about 15 properties a month, so I made quite a lot of money on commission although my commission percentage was still very small. I think I was on 10% when the industry was generally on or about 45% for the same position, but Rogers Senior, who became my very serious mentor, kept on saying to me: “let me train you properly, let me put the foundations correct. A time will come when you will earn at that level.”

TN: Now Homelux has grown to be a big player in the industry with the property development side, valuation advisory services, property management and property sales. How many people are you employing, how big is the operation now? JM: The head office has got about 37 people, sites staff range from probably 150 to 300 depending on the number of projects that we are undertaking. Like right now, we have started on quite a number of projects, so we could probably be 350/400 on various sites.

TN: What has been the main stay of the business? JM: The mainstay is property development, which I really like very much because of the impact and influence that it does. There was a time that I used to think that our product was properties until somewhere along the line I got a revelation that the product is actually not properties, but families; people. That changed quite a significant dimension and I believe the Lord wanted us to see and have that kind of insight because from that point, I can actually check and record that there has been a tremendous increase in business opportunities.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

TN: You are passionate about young people investing in property and I listened to you saying God created land once and He will not create it again…you are passionate about saying to young people, start early, start young. Talk to me about the importance of young people staying in property and your advice to them in terms of how they ought to go about it JM: Yes, God created land once. Real estate in itself becomes an asset of note and any serious investor, businessperson should have a solid real estate investment. Real estate investment by nature is capital intensive, it takes time. My position is start young. If you can start by yourself, go ahead and start; if you can’t start by yourself, try and build a grouping of like-minded people and pool your resources together and start now; start small. The hyperinflationary environment has messed up people in our country. When I started real estate I understood I had to start off in the high-density suburbs — Highfield, Budiriro, you graduate to Warren Park, Warren Park D, you cross to Mabelreign, Mt Pleasant, maybe Borrowdale. But the hyperinflation has created situations and scenarios where a lot of people jumped from zero to Borrowdale. That is 100% fine as long as you have the diligence and the ability to sustain it.

TN: The 99-year leases are bankable; do they give you the confidence? JM: Ninety-nine-year lease is standard. Zambia literally runs on a 99-year lease, Mozambique runs on a 99-year lease, most of the developed countries run on 99-year leases. It’s not the 99-year lease that’s the problem, it’s the credibility. I think that’s what we need to work on.