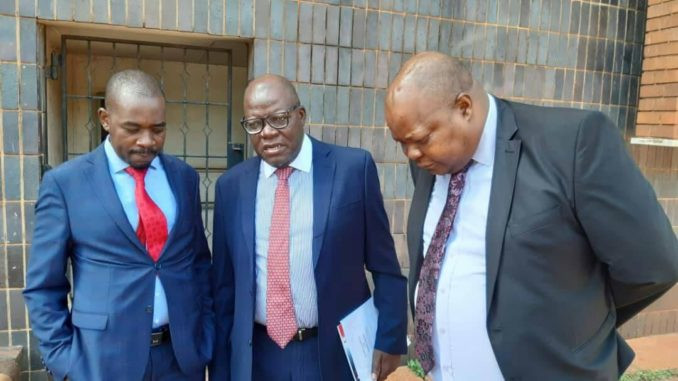

NMBZ Holdings founder James Mushore has spoken of how he evaded arrest and fled to exile over a decade ago after being accused of externalising foreign currency.

Mushore (JM) told Alpha Holdings chairman Trevor Ncube (TN) on the platform In Conversation with Trevor that he was advised to leave the country while on a visit to Kariba after police went searching for him at his Harare home.

The former top banker also spoke about how he helped to start what has become one of the leadings financial institutions in Zimbabwe, NMB Bank.

Below are excerpts from the interview.

TN: I’m going to start exactly where you are right now, semi-retired, retired, where exactly are you?

JM: One can never fully retire, there is always something to keep you busy.

At the moment I am looking after my mother, who is going to be 86 this year.

That’s one of the things my father said on his death bed, look after your mother.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

I also double up as a consultant, people want some assistance in terms of their businesses, and some want finances for their business.

TN: James, you have said you never fully retire, looking at where you are right now and where you started from, what can you tell the 21-year-old James Mushore?

JM: There are some battles not worth fighting.

There are a number of things that if I still have to live my life again I will still do exactly the same.

So far as living in Zimbabwe is concerned, it’s a terrible environment to live in if one is a straight- forward person.

It’s frustrating trying to imagine what one would achieve if they had to show their best foot forward.

My teaching would be: Perseverance, persevere, and continue striving because life is not easy.

TN: Take us through the journey of the schools that you went to.

JM: I started at St Michael’s, which used to be a prep school for Hartmann House and St George’s; they have parted ways now.

In essence my parents were staunch Roman Catholic, we lived in Highfield and every Sunday we attended church at St Peter’s.

One Sunday it was Highfield’s turn to celebrate mass with the archbishop and it was normal for one of the parishioners to take the Archbishop home for breakfast.

The following Sunday after church, Archbishop Francis Mackle came to our house for breakfast.

While making small talk, he asked my dad where we were going to school.

He said I want to start an experiment with multi-racial schooling; would you allow me to use your children for the experiment? The following year my sister went to Nagle House in Marondera and I went to St Michael’s as a boarder.

TN: Talk to me about the highs and lows, waiting (for NMB Bank) to be licenced, that must have been a trying time in your life. Share with me those moments.

JM: It was very expensive for me because I was in the documentation because of my particular experience.

Whilst I was in Zambia I had to often, at very short notice, be in Harare.

I had to often, at very short notice, fly to Harare and I had to charter a plane to pick me up and I had to pretend I had been here all the time before going back to Zambia.

The attitude of the licensing authorities where it was more about putting obstacles in our way than actually assisting us getting involved in the sector, that was particularly frustrating.

TN: Any lessons from that experience?

JM: Sadly this continues till today where we have the pull-down syndrome.

We have this thing where we find it difficult to work with each other. I was very fortunate to work with people, who didn’t care where I came from.

It was a question of working together because of the abilities and qualifications.

TN: Correct me if I’m wrong, James, was NMBZ the first black owned bank to be licensed?

JM: We were not the first bank, there were four banks and we were the fifth. Within 18 months we were the largest merchant bank.

The success came from our hunger to succeed. We also had a number of things we worked on.

We put together systems that would ensure that this would outlive us.

In terms of that success, it was because we were recruiting people in terms of merit, people who were the best at what they did.

Recruiting youngsters that we could train because we could see potential in them and to this day NMB strives for excellence.

TN: You quickly got into facilitating big deal management buyouts IPOs (initial public offerings), how much did that do to cement your reputation and your name in the market, James?

JM: There were no banks doing corporate finance advisory services and this to us had a feel of little competition.

We were the great team bank. One of our philosophies was we can’t be a success on an island. It makes sense if we have more successes.

We believed the more successful black businesses there are, the better.

We would structure things in such a way that we would give them the money to pay directly to their suppliers.

They get the goods, we give them the profits and we also take back part of their loan.

There were a number of black businesses that owed their success to the fact that we were able to structure something for them right from the outset.

TN: The other thing that happened is soon after your struggle to start NMBZ, a number of black banks came in quick succession; something else happened.

I want you to get us to your listing of NMBZ and the dual listing in London. Talk to me about that listing and experience and the thinking behind it.

JM: We got to the stage as NMB where we were not particularly competitive because of where we were able to get capital.

So our thinking was that if we change our licence to a retail bank we would access retail deposits to be able to do more business and so we applied for and we were given a commercial banking licence.

At that time we had also travelled internationally looking for lines of credit. We decided to list in London.

The reason being that getting a listing on the main board of the London Stock Exchange you have to jump through quite a few hoops; being listed speaks volumes.

It shows you have the right organisational place that is properly structured that has a right corporate governance. We did a dual listing on the ZSE and on the LSE.

We raised 30 million pounds. We were over five times oversubscribed. It became easier for us to get more lines of credit.

TN: We have this season where we have more black banks being licenced.

In your view, was it the environment that was relaxed or the regulatory framework had been relaxed? Why suddenly where people not experiencing the kind of hurdles you had in starting a bank, can you explain that?

JM: I would like to think that the authorities could see the benefits of having black-run institutions to the economy.

I would like to think that was what was happening.

I think when people realised that it was a good thing funding black businesses in the economy it became easier for people to start businesses as long as they could prove they had the money.

When Leonard Tsimba left the position of Reserve Bank governor, the inflation rate in Zimbabwe was 259%.

When his successor (Gideon Gono) took over that inflation rate started to grow.

He started printing money, and when you print, the soft currency starts to depreciate.

Now the way banks are structured is that they have to keep a certain liquidity ratio, meaning they have to meet customers’ demands for money.

That liquidity ratio in those days was 30%.

So you had to have liquid or near liquid funds to be able to meet your customers’ demands for money.

A number of banks became illiquid by trying to get into something that was to stop value.

Because of our laws here they became quite illiquid; they couldn’t meet the liquidity ratio.

TN: Are you able to share some of the details of how you left?

JM: On January the 31st of 2004, a Friday, there was a bankers’ dinner and the guest of honour was RBZ governor Gideon Gono.

He started arraying us for CD forms for which we had been acquitted.

The following morning I got a call from the chief of security at NMB saying your office has been tampered with.

I went to the office. My office and my computer had been taken apart.

I went to Kariba a few days later. Whilst I was at the lake I got a call from my wife at the time, now ex, saying last night at midnight eight carloads of policemen came to arrest me.

She told them I wasn’t there and told them to come in the morning.

I went back to our houseboat to pack up and I got a call from someone telling me to leave the country. That is what I did that midnight.

I went through Zambia and eventually went to London.

TN: There were a lot of you being accused of externalising foreign currency and you were supposed to be on the run.

Were you charged and what happened for you to be able to come back into the country?

JM: There was absolutely no money that was externalised by us.

Three years later I said to my colleagues one of us has to go back and meet up with the authorities.

I agreed to come back, in September 2007.

I spoke to my lawyers and the attorney-general. They said they were not looking for me. I went back to London and came back.

When I was at the baggage side I was tapped and told to follow the person.

I went off to this office which was airport police and they said we have got orders to detain you.

I went to my parents’ house and two cars of policemen came to the house saying they had come to take me away.

For three days they could not find a charge for me and I was released after two days of them not finding a proper charge.

I was finally acquitted after nearly a year and only made to pay an equivalent of US$0.10.