ZIMBABWE’S government is a dominant force behind waves of price hikes that have unsettled consumer markets, exerting tremendous pressure on the poor in an economy where 50% can barely survive, according to a comprehensive document submitted to government this week.

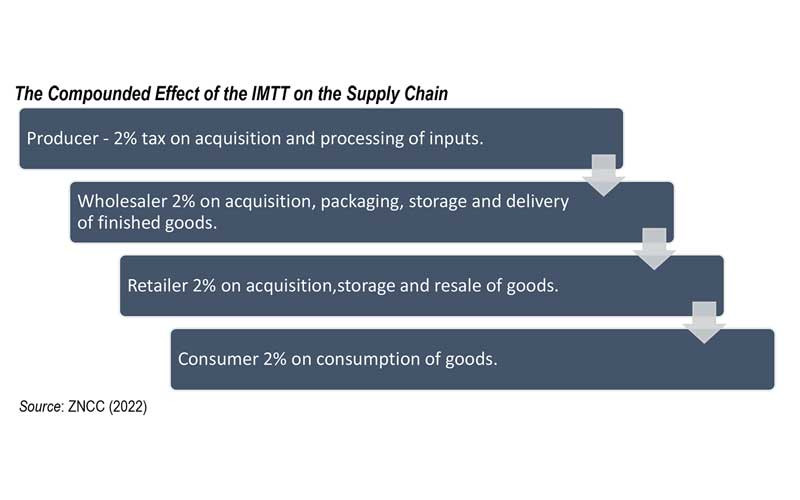

At the vortex of steep surges in the cost of living is the Intermediated Money Transfer Tax (IMTT), which has transformed into a weapon for deducting taxes at multiple layers of value chains to prop up state revenues, according to the Zimbabwe National Chamber of Commerce (ZNCC).

It said this had elicited quick responses from under fire businesses, which pass on added costs to a consumer market already crippled by protracted meltdown.

The 12 page paper, which spells out ZNCC’s views on the upcoming 2024 National Budget, gives fresh insights into the damaging effects of IMTT.

It exposes how the government can easily collect hefty taxes up to four times per single deal.

Ncube is expected to present the budget later this month.

“When 2% IMTT was introduced, the spirit of the tax was to bring into taxation the informal sector, which was not being taxed,” the ZNCC said, as it disclosed how high prices have precipitated tepid demand and suffocated businesses,” the ZNCC said.

“What it has done, however, is to overly tax the formal taxpayers.

- War over super car stuck in river

- Zimra seizes CCC campaign vehicle

- Crime tech: Technology can eradicate corruption

- Firearms smuggling suspect weeps in court

Keep Reading

"Businesses are incurring the IMTT even when paying tax dues to Zimra (Zimbabwe Revenue Authority), thus it is a tax on tax.

“To cushion the supply chain players against the increased cost of production, the cost is passed on to the consumer in the form of price increases across all goods.

“It cannot be emphasised how the intermediate transaction tax has a compounded effect on the supply chain due to the incremental tax charged from the producer to the consumer,” it said.

The groundswell of caution over IMTT, which came into force in 2018, has been escalating.

Around this time last year, chief executive officers and captains of industries told businessdigest that relief from IMTT would be crucial to save struggling businesses already saddled with many statutory obligations.

Under IMTT, government charges 2% tax on transactions.

The tax was introduced after government, confronted by a brutal slowdown in revenue inflows due to a prolonged economic crisis, came up with a plan to draft the informal sector into the tax system.

Key taxes like Pay as You Earn and corporate tax had suffered following the collapse of many firms, as Zimbabwe’s economy haemorrhaged from 2000.

The International Monetary Fund now estimates that about 60% of the country’s gross domestic product is in the informal sector, which government has struggled to tax.

This makes IMTT a vital cog in funding government operations.

In its submission to government last week, the ZNCC demanded significant changes to the way the tax is approached.

“IMTT is not tax deductible,” the ZNCC said.

“Its application has to be different between businesses and consumers. The burden of the IMTT tax is huge on business and, therefore, the chamber proposes that the Ministry of Finance should allow the IMTT to be tax deductible and it should be removed when remitting tax to Zimra.

“When the IMTT was introduced, the value of the tax-exempt transactions was at most US$10. In the 2022 mid-term budget statement, the minister proposed to increase the value of tax-exempt transactions from ZW$1 000 to ZW$2 500.

“As the exchange rate continues to depreciate and to cushion the 44% of Zimbabweans languishing in poverty, it is ideal to upward review the value of tax-exempt transactions to at most US$20 and align this to the exchange rate movement to stimulate aggregate demand in the economy by reducing the effect of the IMTT on disposable incomes.

This should be replicated for corporates,” ZNCC noted.

It also made proposals for cigarette taxes.

“The chamber, on behalf of the tobacco industry players, has previously made submissions to your esteemed office requesting that the excise instrument for cigarettes be changed from a mixed instrument (that is 25% ad valorem and US$5 per 1 000 cigarettes) to a specific only excise instrument, which we believed would be advantageous to the government and the industry alike,” ZNCC said.

“Following our submissions in 2022, a draft model to facilitate the evaluation of the proposal was shared. We continue to look forward to the testing of assumptions and validation of data to be jointly done by the Ministry of Finance, Economic Development and Investment Promotion, and industry players.

“Prior to the conclusion of the evaluation, we respectfully propose that the current mixed excise regime on cigarettes be maintained,” it added.