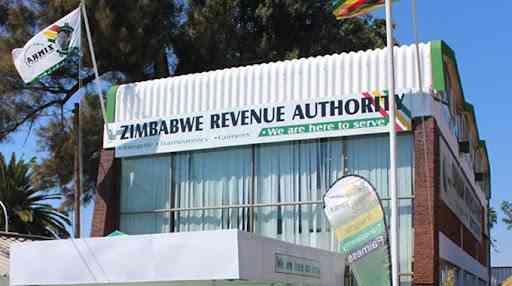

AFROCHINE Smelting Private Limited has been ordered to pay nearly US$3 million in royalties for under-declaring its earnings.

Afrochine Smelting is a company that produces and exports ferrochrome, an alloy of chromium, iron and carbon that is used in steelmaking.

The company had cited Zimbabwe Revenue Authority (Zimra) in its application challenging invoices of US$2 872 897,89 and ZWL$97 682 345 from the tax authority.

The company approached the High Court seeking a declaratory order against Zimra’s calculations to penalise the firm on a 200% scale.

They also sought a declaratory order for the exclusion of the cost of freight.

The firm also sought the court to declare that it is not liable for the penalty for mining royalties amounting to US$2 872 897,89 and ZWL$97 682 345.

Afrochine Smelting further asked the court to set aside the 200% penalty in favour of 100% if they are liable to pay.

In her ruling, Justice Emilia Muchawa said it was the Mines and Minerals Act which obligated registered mines to pay royalties.

- Zimra seizes CCC campaign vehicle

- ZDI defends AK-47 rifles 'smugglers'

- Firearms smuggling suspect weeps in court

- Fresh calls to scrap 2% tax

Keep Reading

She said the method of computation was clearly spelt under certain sections of the Act as read with the schedules of the Finance Act.

The judge said it was the intention of the legislature to levy on a standard benchmark and not ex -works as this would result in different levels for different miners.

“It cannot be held that such a way of levying royalties is interference with the miner’s business decision,” Muchawa ruled.

“It is my finding, therefore, that the applicant (Afrochine) erred in declaring royalties on the face value of the invoice based as it was on the ex-works price of 10 cents less than the fast markets ferro alloys price.

“The justification is that the applicant never received the cost of freight as part of the purchase price and then deducted the freight charge before paying royalties.

“It declared royalties on the face value of the invoice.”

The judge said Afrochine Smelting had erred by excluding the cost of freight from the invoice value.

“It is the State’s intention to recoup royalties from the gross fair market value in order to realise the maximum possible and ensure uniformity on royalties levied across different mining institutions for similar products,” she said.

“This was clearly stated by the minister in his budget statement.”

The judge said the court was urged not to be influenced by the economic challenges which may befall the applicant and simply focus on whether the application falls within the provisions of the taxing law.

“Accordingly, the urgent court application is dismissed with costs,” Justice Muchawa ruled.

According to the background of the matter on June 16, 2023, Zimra delivered a letter to Afrochine Smelting in which it presented its tax review findings for the period 2019 to 2021.

“The company should have paid royalties on minerals based on the gross sale value as shown in the sales schedule from 2019 according to section 37(9) of the Finance Act [Chapter 23:04],” Zimra wrote.

“This resulted in some periods having under-declared royalties on minerals, the difference between the declared royalties and the calculated royalties either resulted in overstated or under declared amounts.”

In response, Afrochine rejected the findings by Zimra and appealed to Zimra Commissioner-General.

There was some engagement between the parties which did not yield any results.

Zimra then sent a reminder to Afrochine to settle the outstanding tax debt before October 23, 2023, failing which the tax authority would institute recovery measures without further correspondence.