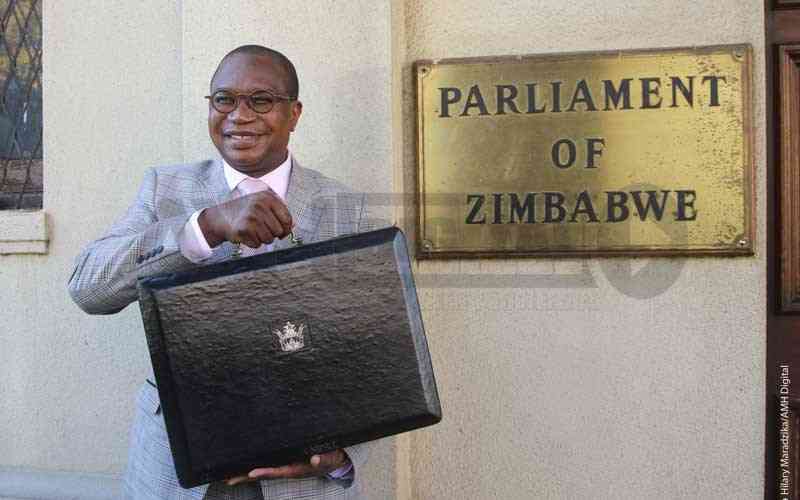

The 2024 budget presented by Finance and Economic Development minister Mthuli Ncube last week is fundamentally flawed because it fails to recognise the fact that the majority of Zimbabweans are mired in degrading poverty.

Ncube projected that treasury will spend about $58.2 trillion next year, up 158% from the $22.6 trillion expenditure ceiling set for this year.

To mobilise the financial resources to oil government operations, the minister is proposing a range of new taxes and to review upwards the existing ones in a way that will hit the pockets of ordinary Zimbabweans very hard.

Ncube proposed to introduce a levy of US$0.02 per gramme of sugar contained in beverages, excluding water, a so-called wealth tax levied at a rate of market values of residential properties with a minimum value of US$100 000 and a 1% levy on gross proceeds of lithium, black granite and other cut or uncut dimensional stones and quarry stones.

The government also wants only licensed and tax compliant operators to procure goods from manufacturers and wholesalers.

Only traders registered for VAT purposes and in possession of valid tax clearance certificates will be eligible to procure goods from manufacturers.

The proposed measures will pile further misery on millions of Zimbabweans that survive through informal businesses.

Although Ncube wants to reduce the VAT registration threshold from US$40 000 to US$25 000 or local currency equivalent, it is common cause that the majority of informal traders will not qualify because they do not make that much money.

- Budget dampens workers’ hopes

- Govt issues $24 billion Covid-19 guarantees

- Letter to my People:They have no answers for Nero’s charisma

- ZMX to enhance farm profitability

Keep Reading

Other revised taxes and charges that will push the cost of living in Zimbabwe include the Strategic Reserve Levy, which will go up by US$0.03 and US$0.05 per litre of diesel and petrol respectively, toll fees on premium roads and passport and selected fees charged by the Central Vehicle Registry.

These increases will push the cost of goods and services beyond the reach of the majority of Zimbabweans, who are already struggling to make ends meet.

As already noted by several critics, the tax regimes that Ncube is proposing in the budget are not pro-poor.

It was expected that the government would craft a budget that takes into consideration the collapse of the local currency and rising inflation, but what is now before Parliament is an unjust budget that will further entrench economic inequality if it is passed in its present form.

It is, therefore, imperative for legislators from across the divide to rise to the challenge and stand up for the rights of the long-suffering Zimbabweans by rejecting some of Ncube’s unrealistic measures when they debate the budget in the coming days.