Zimbabwe’s troubled economy appears to be sinking deeper into the abyss with no sign of relief in sight.

BY NDAMU SANDU

Revenue going into Treasury coffers continues to decline, a reflection of the harsh environment that has spawned massive retrenchments and company closures.

Statistics from the Zimbabwe Revenue Authority (Zimra) show that revenue collected was $878,22 million in the third quarter ended September 30 against a target of $964 million as the economic environment took a toll on revenue heads.

Zimra said that it was now owed $1,9 billion up from $1,4 billion at the beginning of the year as companies fail to remit contributions.

This has raised fears that the authority’s annual revenue collection target of $3,76 billion might not be met.

Taxation generates the revenue needed to finance governments’ economic development policies and creates a framework for development of private sector activities, brokerage firm MMC Capital said in a note to investors.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

It said the shrinking tax base in Zimbabwe was a major cause for concern as it pointed to weaker economic activity ahead.

“The scarcity of internally generated resources to fund key productive sectors of the economy will worsen the government’s balance sheet position. We see scope in formalising the majority of businesses in the informal sector in a bid to shore up the tax revenue base,” it said.

The informal sector accounts for over 90% of employment but has remained outside the tax net.

Analysts warned last week that low revenue inflows to Zimra would continue as companies folded or struggled to remit corporate and pay as you earn (PAYE). The outstanding PAYE as at the end of the third quarter ended September was $601,50 million.

Economist Godfrey Kanyenze said in the wake of low revenue inflows to Treasury, government had to exercise fiscal prudence and “cut its coat according to cloth otherwise it’s going to be a tough time ahead”.

In his mid-term Fiscal Policy review, Finance minister Patrick Chinamasa said government needed to cut the wage bill by at least 50%. Presently Zimbabwe’s government wage bill gobbles 80% of total national budget.

But Kanyenze said such a measure could not be implemented overnight and could only be determined by the political landscape which was complicated by the impending 2008 elections.

“Do you think government will cut jobs? It will be a clear ticket to lose [elections],” he said.

An economist with a local commercial bank said the drop in revenue collection was a symptom of the economic crisis. “Companies continue to close and the few that are around such as Econet, Delta and OK are facing depressed demand and recording significant drops in both volumes and revenue,” he said.

“The combined effect is lower corporate taxes, PAYE and lower VAT due to lower spending.”

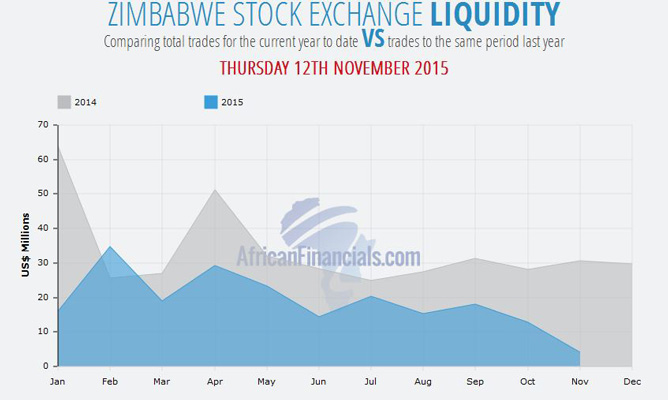

The Zimbabwe Stock Exchange (ZSE), the mirror image on the performance of the economy, has also performed dismally with the October turnover value at $12,8 million being the lowest in six years. This state of affairs threatens the survival of stockbrokers in an industry where five players constitute over 70% of the business.

Analysts say the declining share prices on the ZSE “signify investors lowering their expectations for future revenues for listed companies”.

But investment analyst Gilbert Muponda believes there is a silver lining on the dark cloud if the country addressed two key issues — currency and adherence to the Lima debt clearance plan.

Last month, Zimbabwe’s plan to clear its $1,8 billion arrears to three preferred creditors — the International Monetary Fund (IMF), the World Bank and African Development Bank — was approved and the country expects to clear the arrears by April 30 2016.

“We need to live within our means and make an effort to be a proper country with proper monetary systems backed by our own currency,” Muponda said.

The absence of our own currency has meant that monetary authorities cannot intervene on the exchange rate to boost exports competitiveness.

In a working paper, Assessing the Impact of the Real Effective Exchange Rate on Competitiveness in Zimbabwe, the Reserve Bank of Zimbabwe (RBZ) says the country’s real effective exchange rate has been overvalued since the adoption of the multi-currency regime in 2009.

“The results show the real effective exchange rate gap of about 45% by end of 2014, implying that the currency is overvalued to that extent. The overvalued exchange rate has been hurting export competitiveness, with exports remaining subdued against a huge import bill,” RBZ said.

The situation has been worsened by the depreciating South African rand which has made imports cheaper while exports become more expensive.

This puts further pressure on the country’s external sector. The weakness of the rand also puts significant pressure on remittances from the diaspora given that a large number of Zimbabweans are living in South Africa.

Fiscal and monetary authorities say the country has to undertake fiscal and internal devaluation to eliminate the disparity between the current account norm and the underlying current account deficit.

A fiscal devaluation aims primarily at influencing the competitiveness of a country in the short-term by mimicking the effects of nominal currency devaluation.

The measures include putting a tax on import of goods that are available locally and addressing the cost of doing business.

Zimbabwe sees foreign direct investment (FDI) as the key driver of economic growth. This has seen the country undertaking reforms to improve the ease of doing business. The reforms culminated in the country moving 16 places up the ladder to 155 out of 189 economies on the 2016 World Bank ease of doing business ranking.

Last year, Zimbabwe recorded FDI inflows of $545 million, the highest since 2009. Yet the inflows were insignificant compared to South Africa ($5,7 billion), Mozambique ($4,9 billion) and Zambia ($2,4 billion).