The Harare City Council is owed over ZiG 2,1 billion, with more than half of the being unpaid electricity bills by government entities, a council official has revealed.

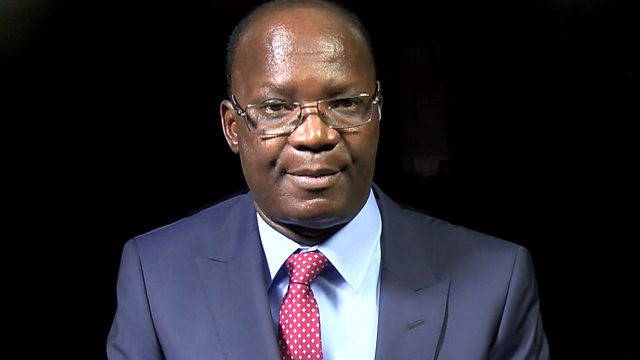

This was disclosed during the presentation of the proposed 2026 budget by the finance committee chairperson, councillor Coster Mande.

He stated that over 60% of the city's total debt originates from domestic consumers.

“As of 30 September 2025, the city is owed ZiG 2,114 billion, up from ZiG 1,4 billion in January 2025. More than half of this debt, 54,83%, comes from electricity bills,” Mande said.

He clarified that debts from government were predominantly settled through intergovernmental offsets.

Mande highlighted that the city's own financial stability is severely strained by high electricity costs, particularly from power-intensive water and sewer systems, which consume a large part of the limited funds meant for service maintenance.

He outlined a targeted debt recovery strategy, noting that the commercial and industrial sectors collectively owe approximately 26% of the total debt, amounting to around ZiG 2,26 billion.

“Therefore, our debt recovery strategy must be precisely targeted, with a focus on addressing the domestic arrears to restore the City’s financial stability,” Mande added.

- Harare cancels Pomona waste deal

- Devolution gains remain a mirage

- Harare cancels Pomona waste deal

- Pomona saga: Harare handed shock US$750k ‘garbage’ bill

Keep Reading

The 2026 budget plan proposes cutting energy costs by adopting solar power across the city.

On staff costs, the council will enforce a policy for employees to use their accumulated leave, as the current leave liability costs the city ZiG 1,54 billion.

The council is also grappling with a foreign currency debt.

“On top of this, the City still owes US$93,5 million from the 2010 Development and Rehabilitation of Water and Sewer Treatment Works project, funded by the China Exim Bank,” Mande said.

This debt, which must be repaid in foreign currency, adds extra pressure on daily operations.

He noted that the council is finalising payment modalities using a special water levy provided for in the 2025 budget.

Mande said the 2026 budget must maximize high-impact, non-billed income streams through fast-tracked approvals, e-platform integration, and improved customer interfaces.

A segmented debt reduction strategy will be implemented: domestic ratepayers will be offered conditional amnesties, while commercial entities will face strict enforcement, including disconnection and litigation.

Mande also highlighted the failure by the central government to release devolution funds as a major setback.

“The failure to release the allocated devolution funds has significantly impacted the city's progress. Many important, already-approved infrastructure projects are now on hold,” he said.

He revealed that in 2020, the City was designated a road authority and had received a total of US$85,2 million as of October 20, 2025.

Of this amount, US$24,5 million was allocated for routine maintenance, while US$60,7 million was earmarked for the reconstruction of the Harare-Seke and Warren Park roads.