Old Mutual Zimbabwe has launched Omari, a mobile money service, and this comes into the market barely a year after Innbucks came into the picture. The mobile money industry is fast becoming a red ocean given the intensifying fight for market share in an informalising economic environment.

A red ocean is an existing market with intense competition among players that not “different in a different way”. Competition in such markets is often bloody and brutal and this underpins the term “red ocean”.

In recent months, the mobile money market that is currently dominated by Ecocash has seen competition coming from Innbucks, and Omari’s entry could result in bloodshed among players. As if this is not enough, the mobile money market, like any sub-sector in Zimbabwe’s financial services industry, has been losing transactions to the cash-only informal sector and unfruitful efforts to instil confidence in the formal banking sector have limited the sector’s growth prospects. We unpack more of this below.

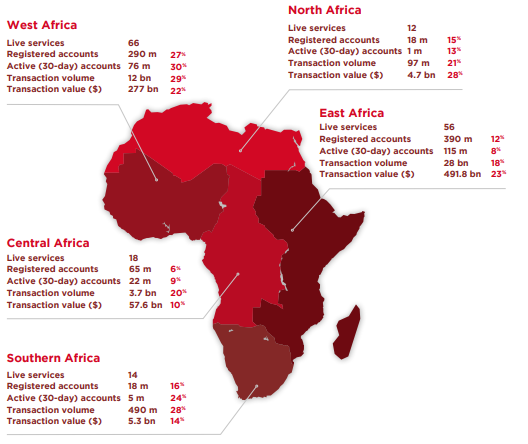

According to GSMA’s 2023 edition of the State of the Industry Report on Mobile Money, the global mobile money market registered 65 billion transactions with a total value of US$1.3 trillion. This industry is largely dominated by Sub-Sahara Africa (SSA) which accounted for 45 billion transactions with a total value of US$832 billion. This roughly translates to market share of 62%. MTN is the arguably the biggest player in SSA considering that it operates in 13 countries on the African continent. In Zimbabwe, Ecocash is the largest mobile money service provider with a near-monopoly.

Although the industry shines on a regional level, the same cannot be said about the local mobile money market. Mobile money agents increased by 41% to 17.4 million in 2022 but a crackdown on Ecocash’s mobile money agents in 2020 that hinged on allegations of facilitating parallel market transactions saw a decline in mobile money transactions from 517.5 million in Q4 2019 to 295.2 million in Q4 2020.

In addition, the inconducive operating environment for doing business in Zimbabwe has pushed economic activity outside the formal system and into the shadow economy.

Cash transactions are prevalent in this shadow economy and mobile money transactions in Zimbabwe have been at the brunt end of the stick. Because of the growing informal economy, the number of transactions had declined further to 187.4 million in Q4 2022.

Ecocash, whose agent lines and bulk payments service were banned in 2020, has been struggling to grow the business in the last 3 years. Ecocash revenues have fallen by almost 30% in real dollars to c.US$120 million during the period in question. Ecocash woes have been compounded by Innbucks which took the country by storm in 2022 and now Omari. The irony is not lost on Ecocash considering that its competitors use Econet’s subscriber base to carve out market share from the mobile money market leader.

- Young vocalist making southern Africa dance

- Letter from America: Visiting with the saints in Masvingo

- Police admit that money changers are untouchable

- Gospel diva launches album in style

Keep Reading

Innbucks poses credible threat given its vast and expansive network that leverages off Simbisa Brands’ 265+ stores nationwide. Innbuck’s also operates on a lean model that is has relatively less costs than its competitors because it piggybacks on Simbisa Brands personnel and infrastructure to a larger extent.

Further, its reliability is enhanced by Simbisa Brands high number of USD cash transactions that ensure that every outlet has capacity to meet the demands of Innbucks users.

Omari, on the other hand, pins its penetration strategy on Old Mutual Zimbabwe’s successful businesses as well as branch network. Old Mutual Zimbabwe is one of the largest life and non-life insurers in the country. Amon its subsidiaries is CABS, a commercial bank with 32 branches nationwide.

Add that to Old Mutual’s 5 branches and you have another potent competitor in Omari. The low switching costs in the industry come as a cherry on top for both Innbucks and Omari.

Taking all the above into consideration, it seems likely that Ecocash could find itself at the mercy of the new mobile money services. The question that remains is, “Has Omari differentiated itself well enough to operate in a blue ocean?” For the novice reader, a blue ocean is an unexplored market that has no competitor and offers first-mover advantages to the first entity to operate in it.The information above suggests that Innbucks operates in blue ocean compared to both Ecocash and Omari. Innbucks is near-cash, low cost, and far-reaching.

These are factors that also count as competitive advantages to the business. There are other services that mobile money service providers offer (insurance, loans, and international money transfers) that we do not count competitive advantages because they do not carve a new market for the players in the same way as Innbucks does.

However, time will tell how dynamic the mobile money industry in Zimbabwe will be after all its players are established and whether these competitors will bump Ecocash off its porch.

- Mtutu is a research analyst at Morgan & Co. — [email protected] or +263 774 795 854.