It’s time to loosen the reins

RESERVE Bank of Zimbabwe (RBZ) governor John Mushayavanhu stands at a critical policy crossroads as he prepares to present his Monetary Policy Statement this month.

By Newsday

Feb. 17, 2026

RBZ’s plan on mono-currency plan sensible

This should, indeed, come as welcome news, if the RBZ sticks to it, for businesses and ordinary citizens who have borne the brunt of past currency changes.

By Eddie Zvinonzwa

Feb. 13, 2026

Forthcoming 2026 MPS: What we expect ahead

With inflation levels hitting their lowest in nearly 30 years and the Zimbabwe Gold (ZiG) exchange rate and inflation stabilising, all eyes are on how this policy will shape the future.

By Zvikomborero Sibanda

Feb. 13, 2026

Why the US dollar remains Zimbabwe’s currency of trust

Buoyed by this stability, RBZ has gone as far as declaring that it is now safer to save in ZiG than in the US dollar.

By Newsday

Feb. 2, 2026

EditorialComment: ZiG ambitions meet old scars in the business sector

Authorities now want the ZiG to become the primary legal tender, ending years of reliance on the US dollar as the dominant currency of trade.

By The Standard

Feb. 1, 2026

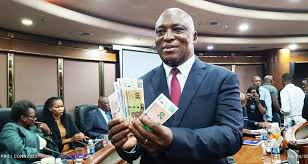

ZiG now better than US$: RBZ

He noted that the foundation for the ZiG’s stability is strengthening, revealing that foreign currency reserves have climbed to US$1,2 billion by December 2025.

By Nizbert Moyo

Jan. 29, 2026

Gold is king again — but Zimbabwe must earn the crown

GOLD raced past US$5 100 per ounce on Monday as investors flocked to the yellow metal for safety amid escalating geopolitical tensions and intensifying trade wars.

By Newsday

Jan. 28, 2026

RBZ has won the stability battle; growth must follow

THE Reserve Bank of Zimbabwe (RBZ) last week released its quarterly snapshot for the period ended December 31, 2025, painting a largely positive picture on currency, price and financial sector

By Newsday

Jan. 19, 2026

Zim’s foreign currency earnings surge past US$16bn

From tobacco, gold and chrome to manufactured products, diaspora remittances and foreign direct investment, the surge in receipts has laid a firm foundation for the transition to NDS2.

By Tatenda Kunaka

Jan. 19, 2026

Tsvangirai turning in his grave, says Chamisa

News

By Tatenda Kunaka and Nqobani Ndlovu

Feb. 15, 2026