Two recent reports by the International Monetary Fund (IMF) and World Bank have put Zimbabwe’s debt at a staggering US$23.3 billion, a big variance from the figures given by the government.

According to the Finance ministry, Zimbabwe’s debt stood at US$21 billion at the end of last year, which means there is a variance of over US$2 billion from the estimates given by the Bretton Woods institutions.

In this publication we report about the latest World Bank economic update that says: “Zimbabwe continues to be in debt distress, with high and unsustainable public debt that limits its access to international financing.

“Due to accumulation of external arrears and legacy debts, total public debt reached US$23,2 billion in 2024 (72,9% of GDP (gross domestic product).”

The assessment tallied with that of the IMF in its 2025 Article IV Consultation Report, which we reported about last week.

Those findings echoed earlier observations by the African Export–Import Bank, which stated in its May country brief that Zimbabwe’s external debt was much higher than official estimates.

Zimbabwe has been accumulating arrears to external creditors for over two decades due to its failure to repay loans. The country cannot access loans from institutions such as the World Bank and the IMF because of the debt problem and that has been weighing down on the economy for many years.

In its report the IMF said: “Total public and publicly guaranteed debt stood at US$23,3 billion (72,9 percent of the gross domestic product) at end 2024.

- Dual economy Zim’s Achilles heel

- Village Rhapsody: How Zimbabwe can improve governance

- Dual economy Zim’s Achilles heel

- Scrap IMTT to save industry, govt urged

Keep Reading

"The external debt stock was us$16, 7 billion (52,5% of GDP). Zimbabwe has been accumulating external arrears to its official creditors since the early 2000s, estimated at US$7,4 billion (23,2 percent of GDP).

“More recently, the government has started accumulating arrears to external commercial creditors, estimated at US$47,4 million at the end of 2024 (0,1 percent of GDP), and suspended servicing some of its domestic debt obligations, amounting to US$425 million (0,8% of GDP) in 2025.”

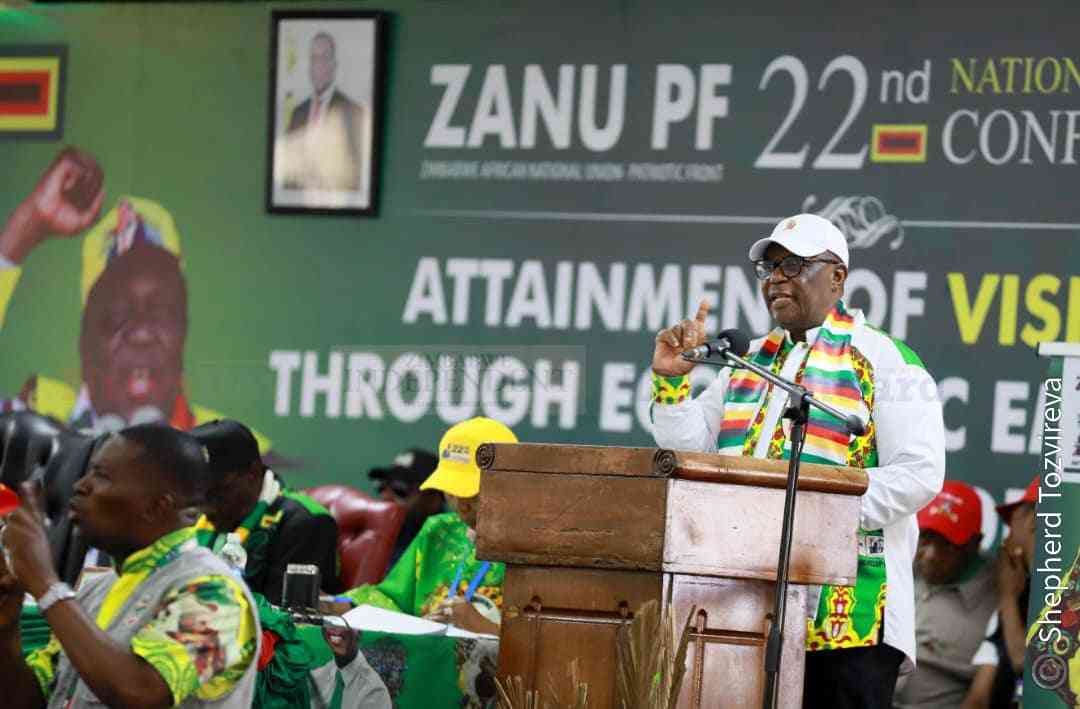

The IMF said the government’s economic policies did not seem to be sufficient to extricate the country from the debt crisis. Since coming into power in 2017, President Emmerson Mnangagwa has been pushing for debt relief with little success.

His reluctance to implement economic and political reforms has continued to stall the debt relief talks.

We foresee the dispute over the level of the country’s indebtedness creating new problems for those that have been working hard to find solutions to the debt crisis. Credibility should be prioritised above everything else.