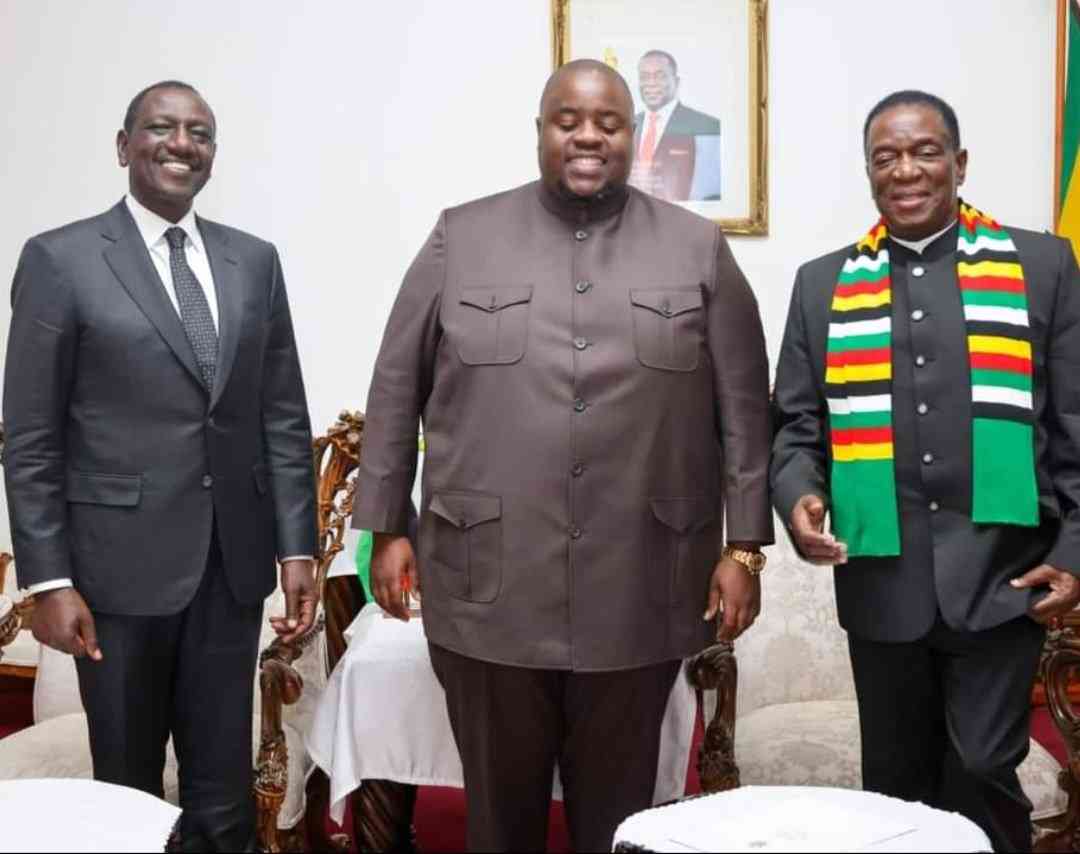

Mnangagwa, Chivayo ties raise eyebrows

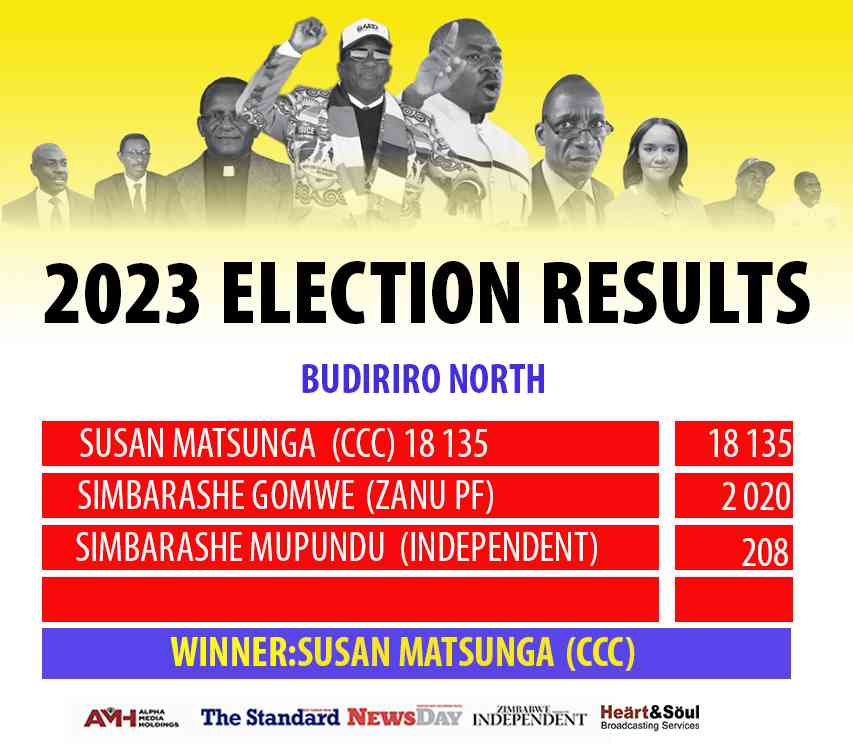

Tshabangu’s CCC pushes for deal with Zanu PF

ZITF 2024 edition was a mixed bag

Winky D incident was yet another own goal

Perspectives: Unleashing the potential of African leaders and shaping a brighter future

Videos

Pamela Marwisa In Conversation With Trevor

‘Embrace index insurance to combat climate change’

Coping with drought through WFP’s resilience programme

DeMbare delight at fan boost

[ad_1] Ndiraya says the support of the fans will have a huge impact on how the teams will perform this weekend. The post DeMbare delight at fan boost appeared first on NewsDay Zimbabwe. [ad_2] Source link

2021/22 PSL fixtures out – NewsDay Zimbabwe

[ad_1] BY FORTUNE MBELE THE 2021/22 Castle Lager Premier Soccer League (PSL) season fixtures were released yesterday with matches set to kick off on Saturday. Giants Dynamos will host Yadah on Match Day 1 while champions FC Platinum will also be home to new boys Tenax as Highlanders hit the road for a date with […]

Kuipers stays in the hunt for Olympics berth

Let them know!

Zim secures multi-million dollar jet deal

Cutbacks leave jet-setting state bosses without ZITF air fares

B/bridge seeks investors for Limpopo River projects

Zim men steal solar equipment in Botswana

Econet in a remittance first for Zimbabwe